This is pretty big news. Kiva has been the only option for individuals who want to invest small amounts of money into micro-entrepreneurs around the world. However, it’s a non-profit organization, so the investor cannot actually make any interest on the money lent.

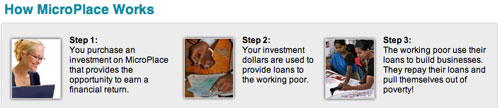

MicroPlace is a new peer-to-peer lending platform backed by eBay that has gone through all the necessary SEC regulatory hoops that make it possible for investors to invest in these individuals and make a return on their investment. It is made primarily for the US market, allowing individuals to loan as little as $50.

For those of us who keep calling for more ways to allow investment money to flow into entrepreneurs hands in Africa, this is a great thing. Personally, I’m glad that an organization the size of eBay was able to muscle their way through the US financial regulatory system in order to put out a platform that allows true investment. Whether or not “real” investors want to get involved in P2P micro-lending, and the inherent risks found in fluctuating currency rates and micro-lenders and -borrowers.

Looking more closely into the opportunities in Africa, I found a total of 4, all offered by the Calvert Foundation. Among them are opportunities with micro-finance institutions in Nigeria, Kenya, Tanzania and Ghana. All of the interest rates are set at 2-3%/per year with a 3 year maturity. Impressively, these 4 organizations manage $72 million, but impact a startling 340,000 active borrowers.

Honestly, I’ve been critical of some of eBay’s efforts around the world before, but not this time. This is an excellently designed site, great functionality and one that fulfills their mission.

More reading:

- BusinessWeek has a really good article on MicroPlace.

- Rob Katz at NextBillion gives a good overview of the differences between MicroPlace and Kiva

October 26, 2007 at 2:06 am

I’m a huge microfinance fan — and this is definitely a huge step in the right direction. I think there is room for both Kiva and MicroPlace to make a huge impact.

I’d love to chat more with you about microlending when you have some free time.

October 30, 2007 at 6:45 pm

Help a young african to achieve his challenge named “The Kerawa Effect”.

It’s here http://ekwogefee.akopo.com/post/2007/10/29/challenge-the-kerawa-effect.-d-day-20

October 30, 2007 at 6:58 pm

Help a young cameroonian to achieve his challenge: get 1000 ads in 20 days.

His article is here http://ekwogefee.akopo.com/post/2007/10/29/challenge-the-kerawa-effect.-d-day-20

You may read it, it’s very interesting

April 30, 2008 at 2:53 pm

What interest rates do you charge the barrowers?

May 29, 2008 at 1:48 pm

I am trying to sollicit for a loan of US$ 20,000 to finish up a promissing hosipitality project in western Uganda.

October 20, 2009 at 2:15 am

how about we lend and invest in our neighbors, not another country.

no offense, but I’d rather give $20 to help a U.S. based business than to go into debt to give money to someone else around the world.

once we as a nation are out of debt, then should we finance everyone else.