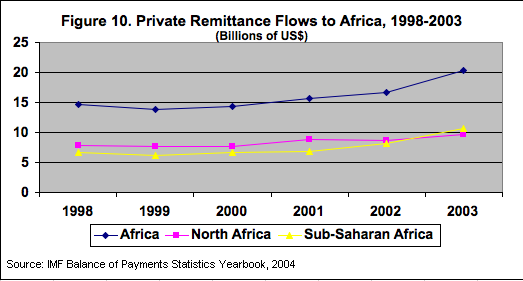

Remittances (money sent back home from Africans living abroad) back to Africa constitute some big numbers for Africa. About $10 billion gets sent to sub-Saharan Africa. That’s the official number of course, a World Bank report stated that it’s likely double that amount, due to Africans using non-traditional means to send capital back home.

Even though that is only 4-5% of the global remittance market, it is still no small amount of money. In fact, it constitutes a huge opportunity for both the middleman helping to transfer the funds, and the countries receiving the capital inflows. What I’d like to focus in on is the middleman.

Why is the cost for sending money back to Africa so exorbitant? Compared to other developing nations, Africans abroad are being fined for being African. You’ll pay two times as much to send money from the US to Uganda ($20) than you would to Mexico ($10).

Why does it cost so much?

First, volume. The amount of money being sent back to Africa, and the competition to handle those transactions are smaller than they are to places like Mexico, parts of Asia and South America. So, simple economies of scale weigh in to the equation.

Second, you have to look at the available options for anyone wishing to send money back to their home country in Africa. Ever since the September 11 attacks in the US, there has been a lot more rules and regulations surrounding any type of capital flow, which has made it harder to operate in this field.

Second, you have to look at the available options for anyone wishing to send money back to their home country in Africa. Ever since the September 11 attacks in the US, there has been a lot more rules and regulations surrounding any type of capital flow, which has made it harder to operate in this field.

The two largest global companies are Western Union and MoneyGram. Bank-to-bank transfers are a less expensive option for some, unfortunately most Africans don’t have a bank account, so that’s not always feasible.

In the past couple of years, we’ve seen voucher-based companies spring up that provide a third option, allowing Africans abroad to buy vouchers over the internet for their families back home. It’s a very interesting field, examples of this include MamaMikes in Kenya and Zimbuyer in Zimbabwe.

Finally, the third way that we’re starting to see money being transferred is through mobile phone credits. WIZZIT and MTN Mobile Moneyin South Africa; M-Pesa in Kenya; Celpay in Zambia and the Democratic Republic of Congo are leading the charge, and we’re likely to see more innovation in this area soon.

Increasing Competition and African Governments

The only true way to drive down costs will be increased competition within the African remittance industry. We’re starting to see that with mobile payment options and voucher-based remittances.

The only true way to drive down costs will be increased competition within the African remittance industry. We’re starting to see that with mobile payment options and voucher-based remittances.

What I also expect to see is more African governments finding ways to make this capital inflow easier. We saw this last year when the Kenyan Minister of Finance, Kimunya, came to the US to talk to the Kenyan diaspora.

This is just too much money to have such a high fee places on transfers. It’s large enough that global and local player will continue to compete and drive the costs down over time.

Other Articles and Resources on African Remittances

- Tracy over at Project Diaspora has an interesting post about remittances to Somalia.

- Ethan Zuckerman on the big business of sending money home.

- The International Monetary Fund (IMF) on making remittances work for Africa.

- UN report on Resource Flows to Africa: An Update on Statistical Trends.

- IFAD remittance forum.

- World Bank report on Remittances: Transaction Costs, Determinants and Informal Flows.

- Report on Migrant Labor Remittances in Africa [PDF]

February 8, 2008 at 2:49 am

Great article and as always you’re championing a better business climate. It’s a small thing but people in the USA can send a MoneyGram to Africa up to $500 for $9.46 at any WalMart.

February 8, 2008 at 3:40 am

Great post, and something I saw you touch upon briefly at Demo 08 (watching via streaming video).

One of my frustrations as an African is that we are largely excluded from the rest of the internet’s payment systems (Paypal, Google Checkout etc). Remittances and e-commerce go both ways, and being excluded like this makes it so much harder for the small entrepreneur to compete globally. A lot of this is due to our exchange controls of course, but there is a real lack of faith in Africa from some of the big internet players

February 8, 2008 at 10:54 am

There are a few african owned remittance business operating from the UK offering good and affodarble alternatives to western union.

I use http://www.moneylineuk.com to send my money to kenya.my family can collect from any branch of equity bank or the money transffered to any account in kenya.only £4 for upto £100 transfrred within 30mins.good value.

February 8, 2008 at 11:58 am

I think one HUGE problem that’s not even mentioned, and lends to the increase costs to transferring money to these locations, is fraud/scams. I’m pretty sure everyone with a pulse is aware of the scams coming out of Nigeria, and the surrounding countries are not all that much better. I’m sure that the costs associated with doing business increase when dealing with this kind of potential loss of funds, dealing with the people involved with the scam on both sides takes resources and more insurance, if you can even be insured. As to PayPal and the like, they’ve simply decided not to do it because of these very issues.

February 8, 2008 at 3:23 pm

tm – you have a valid point, but are the fraud levels in Africa that much bigger than the rest of the world? My time in the online casino industry in the late nineties taught me that fraud is a worldwide problem.

The big providers have a pretty good handle on fraud control, and they are going to have to incorporate Africa sooner rather than later. Why not restrict paymount or turnover amounts to manageable levels while learning in real time how to handle Africa’s particular payment and fraud problems?

The way I see it, the current situation means that the dark continent gets technologically and economically darker while the rest of the world benefits from the lower costs and economy of scale that internet commerce affords.

Nevertheless, fraud and internet identity is a huge problem, and something that we need to tackle head on.

Erik, if you ever pass through South Africa, and Johannesburg in particular, please look me up – I would love to take you to lunch.

February 8, 2008 at 4:14 pm

Most remittances are sent to family members right?

Maybe i’m missing something but a simpler method is just simply using the already existing atm system.

1.Open a dedicated bank account in the states/uk etc. Free checking is common everywhere nowadays.

2. send a visa/mastercard/cirrus atm card to your loved one.

3. call to give them the pin number.

4. you communicate via text on when to withdraw money.

advantages: Bank fees are low since its just the cost of using a foreign ATM. You get the interbank exchange rate, and fraud is kept at a minimum since there is no third party handling the money.

Challenges are of course that ATMs aren’t everywhere. But for that i see expansion opportunities for companies like pesapoint.

I’ve been doing this for years.

February 8, 2008 at 4:29 pm

You forgot a 4th method: Hawala [http://en.wikipedia.org/wiki/Hawala]. It’s efficient, informal, and reliable, and widely used in Somalia – a region with little IT infrastructure.

There is a lot of emotions tied to money; reliability, safety and speed are key for a remittance company to be accepted and successful. The two major players listed have invested huge infrastructure to make this happen, over time.

The Hawala system should be studied and replicated/upgraded with a much more modern touch, I think.

February 10, 2008 at 12:25 am

Thanks for opening my eyes, yet again, to something I never would have seen. In general the way I see money getting transferred is either through bank transfers with people in the rural areas having to travel to the city to find a relative who has a bank account or by sending the money via someone who is travelling abroad meaning the traveller has to take time of their trip to travel to the money’s destination.

Definitely food for thought. Definitely.

February 11, 2008 at 4:44 am

It’s expensive because of the lack of competition, and the stifling regulatory environments. It was the same in mexico, till more players started competing with WU and MG in the remittance field, and that could be the same for Africa too. Banks are cheaper, but they lose on (i) can take 2 days for transfer to be effected (ii) many don’t have bank accounts, and it’s mostly confined to urban areas.

– PS contact Segeni for some pointers on the question you posed

February 12, 2008 at 12:59 am

Thanks for the mention Hash!

The thing I find the most frustrating is that the longer rural Africans remain unbanked the longer it will take them to gain the benefits that a banking system has to offer. ATM cards are HUGELY common methods of money transfer, but it is inconvenient since the ATMs are few and far between unless you live in the city. The more people use the banking system the more likely the banks will be to provide actual banks in African communities. Having access to credit is certainly one step on the path out of poverty. Hawala is another option, but might not be as effective when it is not the cultural norm… its informality also leaves it open to suspicion.

February 17, 2008 at 9:37 pm

I know 20 billion sounds like a lot of money… but when you realize that there are 400 million people living in sub-saharan africa…. that is only $50 per person per year.

So, really it makes very little of a difference in the overall economy.

February 18, 2008 at 1:41 pm

@Njuguna, I know it doesn’t sound like much relative to the rest of the world. However, 400 million people and $20 billion is not small.

I think it would be safe to say that many companies would be happy to access and make a small cut of that $50 transaction. Think of the long tail here. You’re talking smaller margins, but greater volume.

April 26, 2008 at 10:42 am

guys out there (abroad) are sleeping. Why did they go abroad? It is in rare case that they invest back home while they could be the ones taking Africa to the next level. Very few people are doing that. Thanks to those who have contributed to 20 billion. Otherwise, I look forward for the whole africa shopping online. Guys in africa fear loosing money. That is why online shopping is has not yet stuck in their minds. With the few techs cropping up, now there is some light on what can happen online. Digital Villages in Kenya for example could be a big exposure for kenyans to wake up and appreciate doing everything online.

May 26, 2008 at 5:32 am

Remittance market in Africa has been largely ignored by most. This despite the fact that African immigrants are quite large in number. Most immigrants hail from either Asia or South America. The diaspore bonds introduced in Kenya have brought in a new phase of change in the remittance business and other African countries should follow the suit. It is imperative to tap this region becuase the scope is still unexplored.

June 17, 2009 at 12:13 am

Haven’t read the comments yet, so hopefully I’m no re-hashing (no pun intended) anyone’s comment.

Call me crazy, but there’s got to be a way for the guys in Africa who are setting up the various forms of mobile banking to go online. If the African Despora in UK, US, etc. could get online and send money into the mobile banking system in Africa, you’ve got one more huge piece of the pie fixed. Not sure exactly how this would work, but the mobile banks could set up partnerships with the US banks or maybe the AMB (African mobile bank) could set up a western union office in major towns in the US to transfer cash/checks into the mobile system in Africa.

Maybe there’s a whole system in place that I’m just ignorant of that has already solved this problem, but I don’t see anyone talking about it. This is the perfect place for a Western investor business man to step in and create an equal relationship with an Africa company. Not for charity, but for profit (nothing wrong with that) for everyone.

A UK friend of mine serving short-term in Sudan lamented the insane rates that Western Union charged in the rural areas of Uganda. Hash, as you described the simple risks and volumes scale of business, my friend, and I fear MANY more, do not understand the basic economic and business principles that drive the cost of doing business, visa-vi, the cost of using a service. Just a little soap box at the end 🙂

PS. Hash: Amazing post! It really shows that you a handle on the issues you write about.