I haven’t been able to use PayPal for two months. I just got profiled for extra security measures on Facebook. I can’t make certain purchases from Africa. Few organizations ship goods to me here.

Let’s be honest; living in Africa, or being African, gives you a certain unwelcome aroma in the eyes of global corporations. Frankly, we’re just not trustworthy.

The Africa trust problem

This isn’t new to any of us who live, or spend a great deal of time, in Africa. You’re blacklisted, given extra screening, and generally treated like a second-rate human. You’re not trusted, and you’re not worth the time to figure out if you can be trusted.

Frankly, as a total continent-wide user base, we just don’t make enough of a blip on the radar to be worth their time. There’s not enough money here in their minds, there is lower-hanging fruit elsewhere with a lot more spending history – and therefore power.

Does it make it right? No. Do my own stories of wrongs and misbehavior matter? No.

Jon Gosier states it well when reflecting on his blacklisting by PayPal (one of the very worst company offenders):

“Once again, the message perpetuated here is to be cautious when dealing with Africans, Africa or anything you suspect of being related to the aforementioned.”

A closer look at African cyber crime

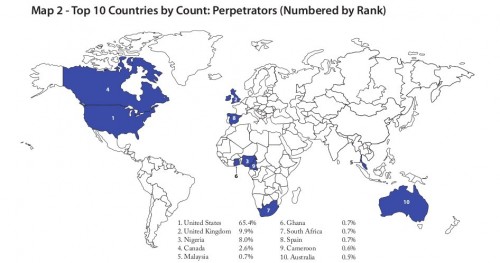

From the Internet Crimes Complaints Centre (IC3) 2009 Annual Report [PDF download]

Nigeria has a significant 8%, but Ghana, South Africa and Cameroon all come in at a measly 0.7%. How in the world do Africans get so much worse treatment for so little compared to the others? There’s no doubt that one country in a continent of 52 countries has a problem – we all get punished for it.

Here are some more interesting statistics, according to the Consumer Fraud Reporting statistics for 2009:

“The majority of reported perpetrators (66.1%) were from the United States; however, a significant number of perpetrators where also located in the United Kingdom , Nigeria , Canada , China, and South Africa.”

So, there are two strong Africa contenders for fraud, but it’s amazing how much more hell internet consumers in African nations (outside of Nigeria and South Africa even!) have to go through in comparison to their much more cybercrime-ridden finalists like the US, Canada and the UK…

Texas in Africa puts this well after a recent foray into this space with Delta:

“it also reflects knee-jerk prejudice and the willingness to write off an entire continent of people as liars and cheaters. The consequences of this attitude are far reaching”

Too true, and there are only two ways that this might change:

First, we in Africa come up with our own payment and business solutions that work here first, and then interact with other global systems.

Second, the global corporates wake up and realize that there is quite a bit of spending power and money to be made in Africa, just like the mobile operators found out in the 90’s.

July 5, 2010 at 5:12 pm

Bad attitude, Africa is still considered a country and not a continent of 53 countries. Inbuilt mentality that may take years to change and that is why your first solution is appealing to me

“First, we in Africa come up with our own payment and business solutions that work here first, and then interact with other global systems.”

Commercial dealings or transactions between Africa businesses and countries should be nurtured. Africans should wake up to the reality facing them and start supporting local solutions and businesses .

At the end this is a big opportunity for the local developers, entrepreneurs, thinkers. Time to come out of the hood and sort out the motherland

July 5, 2010 at 6:26 pm

When I was in Jos last year, I made a purchase on Ebay. Even though the purchase went through my Ebay and Paypal accounts were shut down. I could not reopen them until I returned to the U.S., almost two months later. I would have had to have found a work around if I weren’t going back to the U.S.

July 5, 2010 at 10:36 pm

Another solution: very publicly prosecute and punish the fraudsters. In China, people convicted of corruption get the death penalty. The visible nature of corruption in many African countries are one big reason people see it as so corrupt. Many states in the U.S. have as much if not more corruption than African countries – but it’s arguably not as visible! Look at all of those checkpoints in Africa where police, immigration, customs et al all extort money. It’s just too visible. Everyone doing business in Africa talks about it. We all know there’s corruption elsewhere but it’s just not as obvious.

If the fraudsters are prosecuted and punished, it will gradually clean up the system and this negative image will be dealt a good blow. But when Nigeria’s main anti-corruption guy has to flee the country and visitors to the continent see the hundreds of checkpoints and what happens there, particularly at borders, this problem will persist.

One last comment on the idea of creating its own payment systems: It doesn’t address the problem, which is one of image and branding, not technical capabilities! You can do business with Africa without paypal, after all, there’s western union, bank-t0-bank transfers, etc. It’s all not being utilized as much as it could be because of the image problem….

July 6, 2010 at 12:15 am

‘we in Africa come up with our own payment and business solutions that work here first, and then interact with other global systems.’ thats the way to go and if it becomes more widespread in Africa than any other (e.g. Mpesa) then we take the business intended for Africa.

July 6, 2010 at 2:32 am

Indeed, nonetheless Paypal is now in South Africa. Let’s wait and see, they need to realise that Africa has lots of customers; we just need Paypal to seat with KRA and goverment to set-up terms of use in Kenya so that we can upgrade to merchant account. Still, I can pay with Paypal and my BBK Visa card.

Bank-to-bank transfer = fees are high !!

July 6, 2010 at 2:43 am

I don’t think the numbers are any good.

The report states that: “perpetrator demographics represents information provided to the victim by the prepetrator so actual perpetrator statistics may vary greatly”.

Also the numbers are not per capita and not compared to the number of internet users in that country.

It is very difficult to conclude anything from those numbers.

It is alarming that commenter Alan has his accounts on Ebay and PayPal shut down while in Africa. They don’t turn down money without a reason. Do they do it from prejustice or experience? Is it an image problem or an actual problem?

You need to find out and not look at bad statistics.

I live in Denmark and buy stuff all over the world – but never from Africa. Not because I don’t want to, but I have never come across an African eshop with an international appeal. If there is any, then please point me to it.

I know of only one African service, Ushahidi, which is great but doesn’t really make me feel more comfortable about Africa.

When I surf and search the interwebs I never land on African websites. The continent is simply not on the web. I read a couple of African tech-blogs, this being one of them, but the stuff you write about are allmost never mentioned elswhere.

I don’t know if “being in Africa makes you untrustworthy”, but I think it would help if you made great products that gets the attention around the world. That is easier said than done, I know.

July 6, 2010 at 3:18 am

Those numbers above are absolute? In other words, does Nigeria show 8% of fraud cases when it’s only <1% of the online population (I have no idea, a guess). Operators are looking at the risk that a given interaction, exchange or user will be fraudulent. So legitimate stats would look at fraud incidence per interaction, hour of usage, click, whatever…

This is something I felt when reading TexasinAfrica's post as well – these posts give a persecuted air. Fair enough. But paypal is not a right, it's a service provided by a business. If they choose to limit their customer base in this way, it's their choice. If they are ignorant about the true risk of doing business in Africa, it's their right. Thus I feel a stronger argument (touched upon at the end) is that there's money/customers being left on the table by current players. Then competitors should, even given any increased risk, come and capture that value by addressing the market. Like financing/microfinancing. It seems that reasonably higher interest rates are accepted in microfinancing in Africa, in part to reflect the higher risk of default. A similar response would seem to apply to this case, no? Best way to see whether their practices are reasonable or not is to start a competing service…

Of course that doesn't help you feel better when you can't buy something online – I understand that.

Brendan

July 6, 2010 at 3:25 am

been to USAA.com lately. Just in the last few days, I’ve noticed that not only do I have to log in and provide a pin number, but now I have to answer two profile questions. This is new and has not been required for a simple login in the past.

July 6, 2010 at 3:44 am

Interesting post, HASH. All the responses and the post have missed the issue by several miles. Sorry guys, but this is a perception problem which has to be solved at the levels of diplomacy and media deployment. IT SUITS foreign powers to have Africa in a high risk profile for at least two reasons. Our commodities and raw materials are priced lower while expats who come to African countries and Nigeria especially, since I live there, get to ask for risk allowances. An expat confessed that after going clubbing and partying in Lagos, they then call home to ask for major risk funds as the place is ‘too dangerous’…

The solution of a payment system while interesting will only serve to isolate rather than include. We must truly come up with the right media management approach. This was what worked for Puerto Rico in the past.

July 6, 2010 at 4:09 am

Erik, you cite stats for cybercrime … but what about financial fraud?

July 6, 2010 at 6:20 am

I tell you all a very True Story a cousin of my came over From Nigeria to conduct his Ligitimate Business he had to transfer £15,0000 pounds

to the uk, unaware where of the different Business practices that Govern the Western World. He was forced to use the Mala System in Nigeria

Wherby you pay Nira and collect your Money in sterling .This system all

it works it Fraut with hidden dangers for example you are forced to meet

people on the Streets of london Carrying Large amounts of cash in Plastic Bags. Even when he approached the Banks with his bag of cash he

was treated with mistrust and disdain as far as the banks were concerned

He must be a Drug Dealer or a Fraudster!!!.

The Moral of this Story is that things Need to change Worldwide!!

July 6, 2010 at 6:25 am

@Søren – Lack of payment processing options for African merchants has been the Achilles heel for us online for a long time now. This is directly related to why you can’t/don’t find more great products to buy from Africa online. Believe me, I can walk you into a dozen shops in Nairobi alone that have goods worth buying on the international market.

@BOJ – agreed.

@Brendan – I can’t speak for the reports beyond what you and I can read there, that would be a good question for the report creators. I was showing those numbers more as an example of the level of trust/non-trust associated with our continent not being in line with the general norm. This is why what @BOJ said does hold weight – it’s as much a marketing problem as anything else.

End of the day: this leaves opportunity, so people who do know the real situation should be lining up to make a profit.

July 6, 2010 at 6:33 am

thank you for such an interesting article. I am tired of dealing with this problem as well especially when it becomes country specific. To my surprise, PayPal, the concerpt came from an african unfortunaley leaving in the states (now proud owner of Tesla motors). Its rediculous, global village my ass!

July 6, 2010 at 6:59 am

The irony of course being that the amount of damage done to the global economy by the shenanigans at the likes of Goldman Sachs and the “Win at all cost” means that the Americans and the British are now having to around with the begging bowl asking the other superpowers in Asia to spend with them.

Heck I sat through a breakfast with the Lord Mayor of London recently and he was enthusing about how important it was for South African companies to PLEASE come and invest in the UK…

Times are changing.

July 6, 2010 at 9:17 am

On a similar note, my wife spent some time in Soweto on business and used her credit card to buy some stuff a Maponya mall. Our bank then decided that this is dubious transactional behaviour so blocked her card.

Brendan is right. I think looking at % of cybercrime by country is a little pointless – probably most cyber business is done in the US, so it stands to reason that will also be the country with the highers number in absolute terms of cyber criminals.

July 6, 2010 at 10:26 am

Local banks (and mobile payments operators like Safaricom) are also part of the problem.

July 6, 2010 at 10:29 am

When I have traveled through other continents, and especially Europe, I get pulled aside at the airports and the questioning takes slightly longer and often there are doubts about my travel papers etc. I generally have to do extra explaining…recently wrote an account of of one such trip on http://reflectionsanddeflections.blogspot.com/2010/04/of-travels-visa-and-colour.html

July 6, 2010 at 10:37 am

A friend of mine sent me this link because she’s heard me talk about internet crime and Africa many times. Until a few months ago, I dealt with fraud/abuse for a major internet service provider. Maybe I can give you a view from the other side.

Previous commenters are right. It’s not the absolute amount of fraud coming from Africa. It’s not even the fraud per capita. It’s the ratio of fraudulent transactions to legitimate transactions. If 9 out of 10 offers I get from Africa are fraudulent, it would be unwise of me to take any of them. The chances of taking a loss are simply too high. The same holds even if the majority of transactions are legitimate. On a legitimate transaction, a business will usually make a small percentage in profit. Say, 10%. (For a payment processing company like Paypal, it’s 2-3%. But let’s stick with 10% to be generous.) On a fraudulent transaction, a business will lose the entire amount. 100%. Not just the profit they could have made, but also the initial investment and overhead, which is not recouped. Even in the best case, it takes 9 legitimate sales or transactions merely to break even from 1 fraud.

This is gambling, and not at good odds. For those who say that businesses are overlooking value in Africa, well, you’re right. But only in the sense that someone who doesn’t gamble is overlooking the value available in a casino. If business owner wanted to gamble, he could get a better chance of increasing his money by taking it to Nevada than by taking it to Africa.

Change the odds, and you will attract more people willing to take a risk on Africa.

July 6, 2010 at 11:15 am

I agree 100% that this is an ‘opportunity’ that someone, somewhere should be willing to tackle. I’m actually completely shocked that of all the startups coming from Silicon Valley, Cape Town, and dozens of other cities that nobody has addressed this issue. I’m baffled as to why Africa is blatantly ignored so often, but then again, I’ve been asking myself this question for years and years and have seen barely a ripple in the pond.

If all of these startups really want to design a product or service that is useful and won’t be forgotten in 9 months, forget all of these ridiculous social media services and make something that works in Africa! It’s embarrassing that there is so much intellect being applied to things that don’t advance Africa globally. Think Facebook is revolutionary? Think again.

But as other commenter’s have stated, I also think it is an image issue. I still get the “deer in the headlights” look from people when I mention Africa and technology in the same sentence. C’mon people, aren’t we past this yet? When is the wind of change going to come our way?

Having ease of payments to/from Africa worldwide will have REVOLUTIONARY implications for the people of Africa. It will finally allow them to compete globally as they should be able to do! We need to stop this global apartheid once and for all. Get with it Paypal!

July 6, 2010 at 12:07 pm

More thoughts….

The problem as such is not lack of technology or expertise in Africa to build a payment gateway. Having the technology in place is the least of the problem.

Online payment system runs on trust because in most instances, the delivery of goods and the exchange of currency occurs separately. While the focus is usually on credit card fraud, there is a big issue with dishonest merchants. They take payments and don’t deliver on the promise. This is more common than probably the issue of fraud. Opening an online merchant account is no different from applying for a loan. I think I&M bank in Kenya requires collateral, in the form of cash deposits against the merchant account for this reason.

Any merchant who has dealt with PayPal knows how stringent they are when it comes to dealing with customer complaints. In fact, I think they side with the customer in most disputes.

July 6, 2010 at 4:44 pm

Great Post Eric,

Its only in bringing to the fore this views that meaningful dialogue can surface and proper gaps and opportunities identified.

Its quite unfortunate that it has been painted over and again that its the world first, then Africa last. Almost as though africa has to play the “catch-up game” most of the time. We in Africa are as intelligent and as humanly-capable as any other group of persons walking the face of this earth.

What in my opinion is my meaning is that, we need to pull together that critical mass of persons willing to put together the systems that will address the opportunities and gaps that “we’ can best see.

You are in fact doing this: be strong and very courageous because you speak for the many who are waiting in eager expectations for such solutions.

@ihubnairobi is one such place that the critical mass of techies can assemble and wire the necessary solutions through programming.

I do not doubt the goodwill of the African Persons and that of the friends of Africa to make that difference.

Whatever payment system exists e.g. paypal, it was preceded by ideas which am sure are not foreign unto us. We know we can forge this new solutions if we will to do it.

In my opinion, you drove the point home. Keep writing, keep doing it…

Regards

@UjenziBora

July 6, 2010 at 5:08 pm

i hava a VPN that i use to transact whenever i need to.

But i would add that if Paypal is bad. Try travelling on an African passport.

Easyjet for example refused to fly me from Madrid to Morocco just plain refused even though i had a ticket, had a connecting flight etc, And no refund either.

Air Europa looked for any excuse not to fly me to Madrid from Havana. Had to spend a night at Jose Marti until they ran out of reasons.

So the problem, is much bigger than paypal or transacting online, because even transacting business with Europe or America offline from Africa is already a problem

July 6, 2010 at 7:14 pm

This article resonates so strongly with me right now because just yesterday a payment i had made for a ticket to Kenya on Emirates Airlines was rejected. That apparently they do not accept online payment for flights to Africa. So one has to pay at the airport and the fee one will pay is higher than the nice cheap fee advertised on the internet and which is the reason you want to go by Emirates in the first place. Makes you go like boody hell, then say that on the website in the first place so that i don’t waste my time!

But anyway, this is also related to the concept of ‘soft power’ (Joseph Nye talks about it at length), the reputations countries get from cultural exports (think America- Hollywood, Hiphop, Levi’s, cocacola; Latin America- Samba, Brazilian Wax etc). These cultural exports take the attention away from their seamy sides and grimy underbellies and they keep outsiders focused on the impression they seek to sell. So this soft power is something we need to work on to shift the image from war, ethnic clashes, starving children and famine because obviously, Africa is so much more!

July 7, 2010 at 7:53 pm

Well said. I’ve experienced the same. I did a semester abroad in Nairobi last fall and booked my flight over there and my flight home as 2 one-way trips rather than booking a round-trip flight ( I didn’t know when exactly I’d be coming home). Let’s just say that my credit card company was NOT happy with the fact I was trying to buy a single one-way ticket to Kenya and four months later, a single one-way ticket to Boston. The company placed on automatic stop on my account and I had to make multiple calls to the credit card company as well as British Airways. They ended up having to put my reservation and payment through the system manually. Sigh.

July 10, 2010 at 1:04 pm

@joe

> Many states in the U.S. have as much if not more corruption than African countries – but it’s arguably not as visible!

You have some statistics to back this up, I suppose?

July 10, 2010 at 4:55 pm

This sounds like a huge opportunity… for African entrepreneurs. Africa has the tools, the talent, and the incentive.

Kingwa is absolutely correct. Cameras are cheap and editing software is free. Nothing technical or economic stops Africans from Cairo to Cape Town from exporting music, videos, and movies.

Let us hope that the output does not glamorize criminality.

CWE

July 10, 2010 at 5:08 pm

ummm…

The Nubian Fable on your quotes page pretty much sums up the problem very nicely.

Canadians, New Zealanders, and the Swiss do not tell such pathetic stories about themselves.

July 11, 2010 at 10:31 am

this is a well thought out piece of analyisis, but you have missed a couple of things.

i think the doubters have a point; before you conclude that africans or african based people are being victimised, look at the internet usage stats and compare with the rate of online crime originating from afrika – the picture is very clear that there are very few internet users, but there are too manye fraudsters.

i think it’s the same as air accidents, while afrika has the lowest traffic in the world, it has the highest number of air accidents – the cause is clear. we are not up to it.

we need to have trust among ourselves before we win trust from outside the continent.

July 12, 2010 at 6:29 am

I would refer you to Team Cymru’s whitepaper on African bot distribution, http://www.team-cymru.org/ReadingRoom/Whitepapers/.

The digital scramble for Africa is well underway, but given that only 5 of the 53 African countries have adopted the Council of Europe’s Convention of Cybercrime to draft e-legislation, a lot remains to be done.

Information Security for Africa (ISfA) is a not-for-profit organisation dedicated to the advancement and development of information security on the African continent.

July 12, 2010 at 6:48 am

Erik, you hit the nail on the head. Africa has done well but is yet to earn global respect. I don’t know why it hasn’t and when it will 🙁

July 13, 2010 at 11:04 pm

Hash – How much does the local Juma or Salim need this credit system per se. Since we have the hawalas and MPESA type transactions? How much online transaction is there today or is the problem just an inconvenience for those that are Diaspora but live in the African cities temporarily?

July 14, 2010 at 5:04 am

@ Qurba Joog

I think you’ll find that it’s a MAJOR problem for people living IN Africa. As the author points out, PayPal is suspicious BECAUSE the author has an African mailing address. PayPal, Facebook et al are guilty of online profiling which would normally provoke an outcry in the real world.

Kenya was the first country in the world to adopt M-Pesa and the success of it there meant it has been adopted in other African countries and beyond. Infact as this article shows, http://allafrica.com/stories/201007020876.html, the US is considering it too.

If PayPal and Facebook make it difficult for African residents to use their services, then homegrown alternatives should be considered – in China, Baidu is the biggest search engine not Google. Likewise in Brazil, Orkut is the biggest social networking site and not Facebook.

August 5, 2010 at 6:19 am

Working in Africa for a fair portion of each year, I had trouble using my credit cards. My business service providers (Chase, primarily) graciously allowed me to browbeat them into removing the automated restrictions regarding where I could use the cards. It took a few phone calls.

A larger difficulty is drop-shipping purchases to an African destination. If I want a Dell computer for use in Sao Tome & Principe, I have to buy it in the US and carry it as excess baggage to the country personally. We need secure destination services that outside vendors can trust to deliver their products to us.

A business opportunity? I wonder if we might persuade the local management of DHL or FEDEX to negotiate directly with Dell and a few other major vendors for guaranteed service in a few major African cities; then advertise the service. Think it would generate some change?

September 1, 2010 at 10:58 am

@infosecafrica

I agree with your assessment however the question still remains what is the impact to local traders. Yes I agree this is painful (time & ego) for folks buying from the Internet and are in Africa by this but majority of local do business electronically local or say regionally in East Africa with mPesa for example.

I would like to point out that additional tools are available now for example Idd Salim’s creation Pay Zunguka (feature by @Hash).

Anyway I think we may also need not just a payment and credit facility that suits Africa but also Logistics, electronic B2B & B&C ecosystem that brings all local shops, informal economy and even the Hawala system to the electronic age and better understands the local economy instead of wholly relying on systems that don’t understand or care much about you.

September 4, 2010 at 4:50 am

Well, PayPal is available to Kenyans finally. I found this out by accident after logging on to my PayPal account and found additional buttons, including Request money button. However, even though Kenyan PayPal accounts can be used to receive money, one still needs a US virtual bank account to withdraw the money. Hope this will be sorted out by a local bank, or perhaps PP allow Kenyans to withdraw using a prepaid debit card (me thinks pre-paid debit would be the best option–exchange rates offered by local banks for foreign cash tends to be absurdly exploitative).

I am sure most will despair upon hearing you need a US account, but there are ways of getting around that without buying a 2-way ticket to US to open an account. Just apply for a virtual US bank account from Payoneer. It functions like a normal bank account, and includes a routing (ABA) number and an account number. Charges; $20 per year. Rules of eligibility are a bit stringent but worth it. Just processed the first payment and it works like heaven.

Those with foreign based accounts, maybe its high time you deactivated them.

September 4, 2010 at 5:08 am

A few things I should have added.

I have read the Country specific terms for South Africa PayPal service and I have to say its a quite limited service there. Our market is not as heavily regulated as South Africa and hopefully we shall access more services here. I also think that Kenya case was bolstered by the high profile of the mobile payment solution there (M-Pesa) which has consistently made international headlines, plus relatively low cases of fraud, a big tourism destination plus many other factors.

February 13, 2011 at 5:42 pm

“…Let’s be honest; living in Africa, or being African, gives you a certain unwelcome aroma in the eyes of global corporations. Frankly, we’re just not trustworthy…”

Welcome to Africa mzee

🙂