Russell Southwood’s Balancing-Act newsletter is one of the best sources for internet and mobile statistics and reports in Africa. If you don’t read it, you should. If you run any type of mobile, web, or ISP-type company in Africa and you can afford it, then you should be buying the reports. Here are some excerpts from the recent one on Broadband Markets in Africa with some opinions thrown in by me.

Every country needs a price wiki

“Confusing range of pricing structures: Different pricing structures are applied to different delivery technologies (DSL, CDMA, WiMax, GPRS, EDGE, 3G, etc) and this makes “like-for-like†comparisons across all African countries an almost impossible task.”

No matter where you go in Africa there is no easy way to find out what types of broadband connections are available. There would be nothing more useful than a wiki-like tool that people could add to and compare against. A place where people who use these tools can put up their experiences and let others know about the “true” bandwidth provided by companies. This is especially true for residential customers.

Geographic broadband penetration

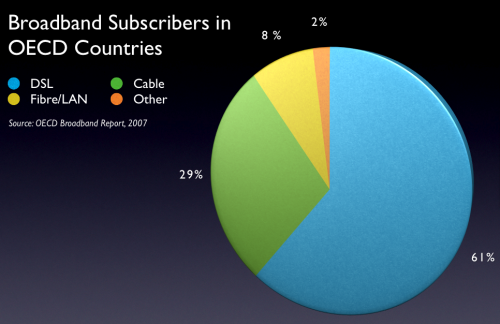

In the world’s most developed OECD countries, 61% of subscribers got their broadband through DSL services by 2007, 29% through Cable TV (CATV), and 8% through Fibre LAN connections. Just 2% of subscribers – some 3.455 million – subscribed to broadband through ‘other’ fixed wireless broadband services. In Africa, some 59% of broadband subscribers use DSL, just 1% use CATV, and the remaining 40% use wireless broadband.

Broadband to OECD countries in Africa by type

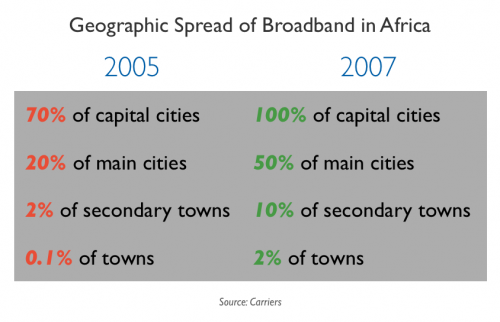

By December 2007 terrestrial broadband networks were now available in every capital city in Africa, some 50% of main cities, 10% of secondary cities and 2% of towns.

Traditional media is still king

Users in the more developed broadband markets make the Internet a modest supplement to a diet composed mainly of radio and television. As South African media owner Prakash Desai, CEO, Johnnic has pointed out in October 2007:â€99.9% of revenues are offline. The Internet doesn’t feature.â€

As elsewhere, the Internet in Africa has a symbiotic relationship with other media, particularly television. After a controversial scene in the second series of Big Brother, there were five million downloads of that scene. Ninety per cent of those downloads came from within Africa and of those 33% were from South Africa and 37% from Nigeria and Uganda. Similar response rates on SMS voting and competitions shows that this will be fertile ground for broadband content development as the subscriber numbers increases.

Mobile providers hold the high ground

On a continent that has a wide variation in the amount of internet access available when moving from urban to rural settings, the hand tips to those that have lower costs in rolling out infrastructure. Land lines, cable and fibre all cost a great deal to deploy. Mobile phone carriers have the ability to do so at a lower cost through towers. It’s a node vs line problem.

The key battle ground in the next five years will be between 3G services (or higher) offered by GSM and CDMA operators and fixed wireless broadband services. The outcome of this battle will shape the broadband experience in Africa, whether customers use mobiles as Internet access devices. …Mobile operators launching 3G networks are offering access speeds which compete with the broadband wireless services.

When that access is just as fast as land lines, then there’s no reason at all to stick with an internet solution that forces you to stay in one place.