I’m happy to finally be able to publicly announce the Savannah Fund, an accelerator fund focused on finding and investing in East Africa’s highest potential pre-revenue startups. It’s a partnership between Mbwana Alliy, Paul Bragiel and myself – along with a great list of limited partners (LPs) who are investing in the fund.

The idea is to bring the Silicon Valley-style accelerator model to Africa, seeing what needs to be tweaked to make it work for our region. It’s a small fund at $10m, with most of the activity focused on classes of 5 startups at a time being brought on board and invested in. They’ll get $25,000 for 15% equity, and have 3-6 months to prove themselves. Those who fail either pivot or leave, those who gain traction have a chance at follow-on funding. A portion of the fund will be invested at the $100-200k range where we’ll look at follow-on funding for the startups in our program, and also at other high-growth tech companies in the region.

We’ll be looking throughout the region for these investments, from Rwanda and Tanzania to Uganda, South Sudan and Kenya. You can put in an application now, though the first cohort will not be accepted into the program until the end of the Summer (Aug/Sept timeframe).

At this stage we’ve raised half of the fund, which allows us to get moving. 35% of the fund has been raised from local investors, such as Karanja Macharia from Mobile Planet. We also have big US names on board, such as Yelp co-founder Russ Simmons, Tim Draper, Dave McClure, and Roger Dickey and Dali Kilani of Zynga.

Why I’m involved

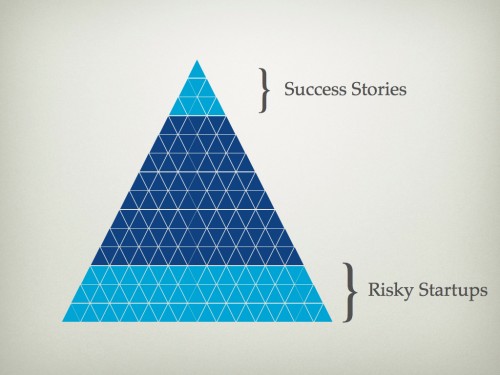

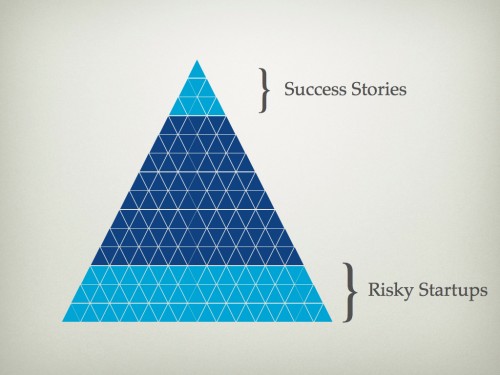

The reason I’m involved with Savannah Fund is very simple, I’m focused on getting the foundation of our technology future in place. In East Africa, we don’t have enough mid-cap investment opportunities in tech, and the only way to change that is increase the size of the base of that success pyramid.

Some history. Over a year ago I met with Ben Matranga from the Soros Economic Development Fund who noted that there were a number of interesting small startups, but they were too small for them to invest in. If there was a smaller fund, someone focused on this space, they’d be interested in using them as a vector to stir up the bottom and help uncover more successful companies over the next 3-5 years. At Pivot 25 last year I met up with Mbwana and we started to discuss the fact that most startups here aren’t ready for VC fund and how we might be the right people to create the needed vehicle.

Fast forward to September 2011 and Paul, Mbwana and I decided to go ahead and do it. Hours and months of due diligence, pitching and phone calls later we finally are getting it off the ground.

- My role is to help find the new companies and to connect them to the businesses in the area.

- Mbwana’s role is to manage the fund and the startups in it.

- Paul’s role is to connect the Savannah Fund startups to Silicon Valley businesses and investors.

As Mbwana says, “We’re a fund for entrepreneurs by entrepreneurs”. We’re here for the small guy and our goal is to find those risky tech startups with hungry, passionate founders that will do the hard work it takes to become a successful company.

Find us on Twitter at @SavannahFund