Kenya is quickly gaining a competitive advantage in the mobile payments space. Led by mobile operator giant Safaricom with their Mpesa product, the market locally sees huge value in mobile money transactions. Add to that a regulatory system that is relaxed enough for innovation to be encouraged, and you have a great space for interesting things to happen.

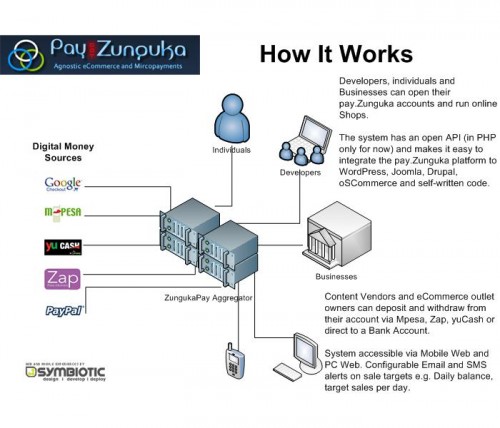

Pay.Zunguka

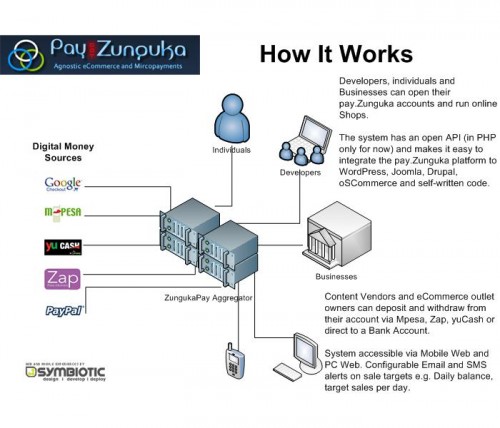

The team at Symbiotic always have more than one iron in the fire. I was surprised by their most recent release of a new product called Pay.Zunguka last week. Simply put, it’s a payment gateway and aggregator, allowing merchants, developers and content providers a way to monetize their work with the public.

There are two sources of inspiration in Pay.Zunguka (guys, we need to talk about names at some point…), that is the ability for people to utilize international online payment methods like PayPal and Google Checkout, but more importantly that users here in Kenya can do it all without a credit card, only using their phones. That’s a big deal, and it’s a nod towards recognizing that credit cards aren’t necessary, we can bypass that mess.

Mbugua Njihia, CEO of Symbiotic, tells me that their plan is to first integrate with content providers and create an easy-to-use micropayment space, charging 3% per transaction. This will be followed by a partnership campaign to work with larger organizations who don’t have an efficient payment platform for consumers.

PesaPal

PesaPal I’ve written about before. It’s a mobile payment gateway as well, but one with a specific focus online. Liko and team have made great headway recently, but not just in the technology, which is critical. They’ve made headway in some other important areas, funding and marketing.

We’ve talked about the need for local investors to buy into local technology startups. When that doesn’t happen, the international ones swoop in and take advantage of local investor myopia. In this case, PesaPal is receiving a healthy seed capital investment for scaling and marketing. With cash flow happening right now, it’s a good time to invest, and I’m glad to see someone doing so with this team.

I talked to Liko yesterday about this. Their strategy has shifted somewhat since last year, instead of just focusing on web merchants, the PesaPal team is working on relationships with educational institutions and educational book suppliers to make parents lives easier when their child starts the school year. The parent can now pay their child’s school fees using Mpesa or Zap, and then are directly linked to the list of that year’s books with the option to buy them too, and have them delivered to the school for their child’s first day. Brilliant!

This is the kind of fresh thinking that is great to see coming from tech startups: they’re not thinking or selling the tech, they’re selling a solution to a problem.

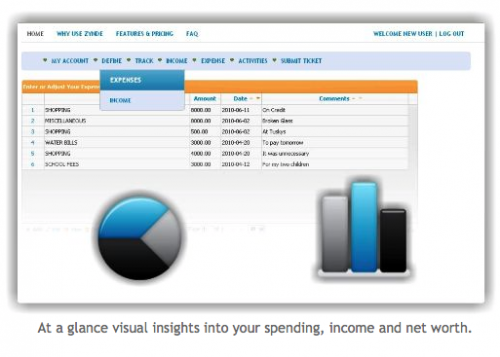

Zynde

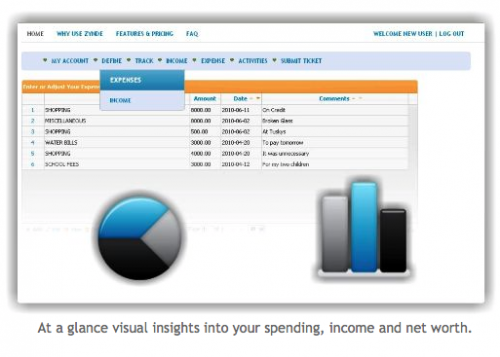

Zynde is a new player in the space, but you’ll start to see a pattern here when you jump over to their website. Because none of the large companies are addressing the very real need for agnostic payment gateways the market is filling in that gap for them.

A quick email chat with David Kagiri of Zynde gave me more insight into their focus behind the service:

“My main driver was that new technologies existed that could enable me deliver cost effective solutions. After interaction with owners of small businesses I realized that most don’t keep track of their business finances and the cost of the available off shelf software that would help them with that was beyond their reach. I came up with a simple solution that uses the SaaS (software as a service) model so that I could deliver cost-effective solutions to them and an API that will enable creative developers to extend it to multiple mobile platforms and reach the masses.”

Zynde will have to prove themselves in what is quickly turning out to be a highly competitive space with competent players.