Kenya is quickly gaining a competitive advantage in the mobile payments space. Led by mobile operator giant Safaricom with their Mpesa product, the market locally sees huge value in mobile money transactions. Add to that a regulatory system that is relaxed enough for innovation to be encouraged, and you have a great space for interesting things to happen.

Pay.Zunguka

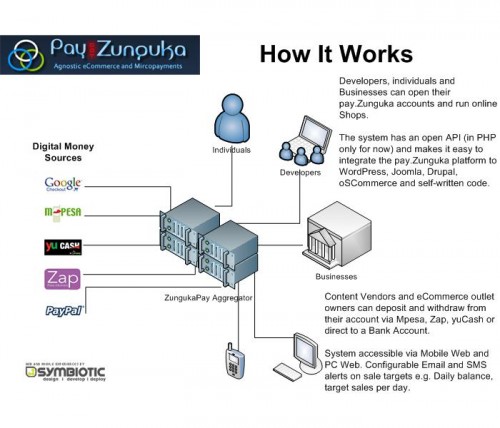

The team at Symbiotic always have more than one iron in the fire. I was surprised by their most recent release of a new product called Pay.Zunguka last week. Simply put, it’s a payment gateway and aggregator, allowing merchants, developers and content providers a way to monetize their work with the public.

There are two sources of inspiration in Pay.Zunguka (guys, we need to talk about names at some point…), that is the ability for people to utilize international online payment methods like PayPal and Google Checkout, but more importantly that users here in Kenya can do it all without a credit card, only using their phones. That’s a big deal, and it’s a nod towards recognizing that credit cards aren’t necessary, we can bypass that mess.

Mbugua Njihia, CEO of Symbiotic, tells me that their plan is to first integrate with content providers and create an easy-to-use micropayment space, charging 3% per transaction. This will be followed by a partnership campaign to work with larger organizations who don’t have an efficient payment platform for consumers.

PesaPal

PesaPal I’ve written about before. It’s a mobile payment gateway as well, but one with a specific focus online. Liko and team have made great headway recently, but not just in the technology, which is critical. They’ve made headway in some other important areas, funding and marketing.

We’ve talked about the need for local investors to buy into local technology startups. When that doesn’t happen, the international ones swoop in and take advantage of local investor myopia. In this case, PesaPal is receiving a healthy seed capital investment for scaling and marketing. With cash flow happening right now, it’s a good time to invest, and I’m glad to see someone doing so with this team.

I talked to Liko yesterday about this. Their strategy has shifted somewhat since last year, instead of just focusing on web merchants, the PesaPal team is working on relationships with educational institutions and educational book suppliers to make parents lives easier when their child starts the school year. The parent can now pay their child’s school fees using Mpesa or Zap, and then are directly linked to the list of that year’s books with the option to buy them too, and have them delivered to the school for their child’s first day. Brilliant!

This is the kind of fresh thinking that is great to see coming from tech startups: they’re not thinking or selling the tech, they’re selling a solution to a problem.

Zynde

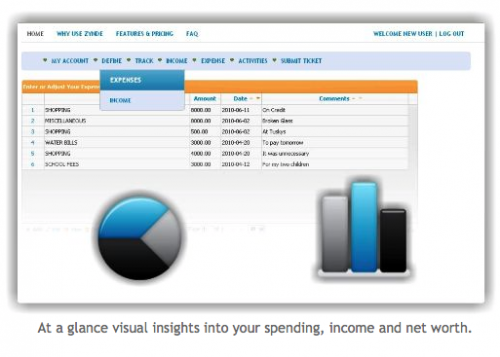

Zynde is a new player in the space, but you’ll start to see a pattern here when you jump over to their website. Because none of the large companies are addressing the very real need for agnostic payment gateways the market is filling in that gap for them.

A quick email chat with David Kagiri of Zynde gave me more insight into their focus behind the service:

“My main driver was that new technologies existed that could enable me deliver cost effective solutions. After interaction with owners of small businesses I realized that most don’t keep track of their business finances and the cost of the available off shelf software that would help them with that was beyond their reach. I came up with a simple solution that uses the SaaS (software as a service) model so that I could deliver cost-effective solutions to them and an API that will enable creative developers to extend it to multiple mobile platforms and reach the masses.”

Zynde will have to prove themselves in what is quickly turning out to be a highly competitive space with competent players.

July 29, 2010 at 2:48 am

This is good news for everyone it the industry. Such enterprise needs to be encouraged but we also need legislative infrastructure in place because this is money after all. Secondly we need to think beyond this country- the Kenyan market for digital finance is not big enough for five mpesa-like companies. We should be looking towards east africa and the whole continent

July 29, 2010 at 10:39 am

Create the right incentives, and they will build. While corporate giants can create the infrastructure, it’s always going to be the fundi’s tinkering in the proverbial garage that makes it tick.

July 29, 2010 at 3:00 pm

Sounds like developments to call ‘innovations’ for once.

If these small Kenyan outfits can get bought out by some of the technology big fish we shall have some serious forex inflows into the country. Much more valuable than slippery donor funding for economic our advancement.

July 30, 2010 at 10:16 am

Pay Zunguka?!

Yikes! Who came up with that name? If it’s going to have a global reach, that might be a tough name to promote!

July 31, 2010 at 2:57 am

Yes, Eric…we are working on the name…suggestions invited from all. We opted to just put it out there…as i told you some of the finer details and differentiators are coming, keeping those under-wraps for now, but it will preset a win win for operators, content providers and developers alike.

July 31, 2010 at 3:06 am

@Ryan…noted, as i commented earlier we put it out their to get feedback on the service, you will notice that pay.zunguka is simply the name of the sub domain where the service is currently running from in beta

July 31, 2010 at 3:33 am

Nimeskia. We decided to focus on the product rather than the name first.

August 23, 2010 at 4:18 am

I have been following the growth of web based pay systems in Kenya and i have made the observation that most of the pay systems meet not the minimum security requirement of having an extended validation ssl certificate.Since most of the systems are based and registered in Kenya,its laughable that one can say the system is secure with a $19 to $64 godaddy or rapidcert certificate.I hate to be the prophet of doom but check this this out.2checkout has been accepting paypal payments for users anywhere in the world save for countries enjoying the privellege of messing the the big us of A(trade embargos).

Mobile pay systems in Kenya i imagine have a central server running some sort of relational database.Hooking an Api to a database is a night’s job and the announcement in the morning.Case in point,http://code.google.com/p/mod-ndb/

I have seen several api’s and boy,they have a long way to go.I am not discouraging anyone but it helps to see that all this buzz is headed where most hyped projects go;into the drain bellow;that’s just my opinion.

August 23, 2010 at 7:58 am

@kimani. Thanks for your opinion. I am sure you can crack the traffic encryption on those USD 64 certificates in your sleep. Would it offend you if I mentioned that there are even FREE certificates available and work?

August 23, 2010 at 9:59 am

Its interesting that you choose to speak of Ssls.In my opinion again,nowadays the reputation of the certificate authoring body that takes all the reputations and not some cheap knocks off the shelf of a bubbling p.r. flick,resellers and marketing evangelists.You are right,i cannot decode info on transmit on a $64 worth of cert,but for your keen intellect on the matter,thanks for pointing out,its worth the whole 5 bucks.

I am kind of straight observer.My point is,should the service providers hosting all the data on the mobile money platforms,the hardwork,investment and enthusiasm will be wiped out with very little effort by the mobile carriers.

I was then wondering why you would wanna make a mobile pay system with such little information,like yo do not have a direct api to the mpesa platform for instance.Secondly,i was in my eve of my enthusiasm to reliably point out the wonderful mysql over http package i showed you for apache and mysql to serve as an example,but i thought you saw it.

Thanks.

August 23, 2010 at 10:18 am

I dont mean to over show anything,just making an informed point from my side of the table.Case in point.Upon nick-nuffing(just a fancy word i made up meaning;visiting sites and laughing out loud),i have observed that,zynde is using an authentication library straight from codeigniter’s wiki by dxshell team,an asia outfit i believe.Dx auth is somewhat borrowed from cl auth by ashwood of the uk,but the project has since been dead and gone.

For the curious heads here is a link:http://dexcell.shinsengumiteam.com/dx_auth/index.html

The ssl procedure of securing the assets so to say is also a good starting point for comedy students and for crying out loud,while dx auth is a good choice,have the courtesy of changing auth.php controller to something else less suspect.The backend controller in the admin folder is still there for the even curious heads who went ahead and downloaded dx auth.

So to make the point of the day “Pay systems like all other deposit taking institutions in kenya are regulated by the central bank.Thinking you could hide behind the free flag of the internet is one cool business plan,but consumers beware;its free enterprise but the name of the game;is and has always been;CAN I TRUST YOU;and that is what is lacking”.

Oh and for the punchline ladies and gentlemen;

http://validator.w3.org/check?uri=http%3A%2F%2Fwww.zynde.com%2F&charset=%28detect+automatically%29&doctype=Inline&group=0

Thanks again.

August 23, 2010 at 10:27 am

@kimani – Ok. Fair enough. We will all get USD 10, 000 SSL certificates and will ask the Zynde team to validate their CSS, lest no one will use their site because it has 37 mundane html errors.

I even fear for facebook as they also have errors. I am sure 1M people will de-register today.

http://validator.w3.org/check?uri=http%3A%2F%2Fwww.facebook.com%2F&charset=%28detect+automatically%29&doctype=Inline&group=0

August 23, 2010 at 10:39 am

I am guessing you were dead serious when posting the facebook link and even suggesting i am inciting a kind of panic attack;facebook like any other web application not made of codeigniter i guess totally missed this post by Elliot.That should kill your curiosity.

http://www.haughin.com/2010/02/23/building-utf8-compatible-codeigniter-applications/

Okay,the point i have been making all along is,developers of an upcoming pay system should make sure that the idea built around things that are reputable and at least have the courtesy of realizing not all internet users are saints;well in Eminems words “Some are thiefs(data in this case)”.

Success building the next paypal mate,i wish you well, i really do.