There’s an good post over at the CGAP blog about mobile money’s innovation crisis. The author claims that nothing new has happened in mobile money since Mpesa was launched in Kenya, except for maybe the launch of Mkesho this year in Kenya as well. Besides that, everyone around the world pretty much tries to duplicate what Safaricom is doing in this space.

Why?

“There may also be one partnership in particular that could be hampering innovation—that with the banks. Historically, these two players have taken very different strategies for new product development, especially in resource poor countries.”

Thinking big picture

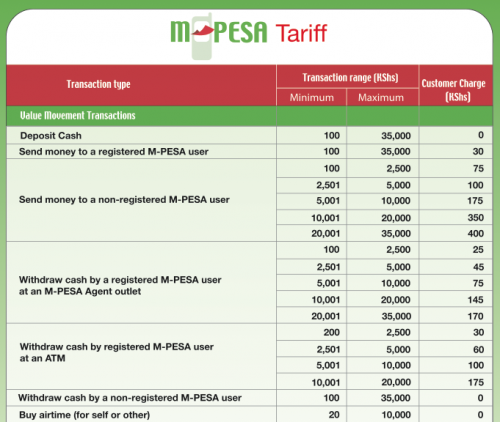

You can send up to $500 for as little as 37 cents using Mpesa. On Zain it will cost you 74 cents. That’s an insanely low transaction cost compared to what banks charge, and that’s not even going into the fact that they can’t do transactions as low as 50 to 100 Ksh ($.60 to $1.24). The kicker, you can store your money in it for no fee at all (unlike the usurious rates that the banks charge).

Simply put, banks cannot compete with mobile operators when it comes to transacting payments for the majority of Africans.

Regulators make and enforce the rules around everything. How do they make their decisions, who lobbies them and why? Is the reason that we haven’t seen a true replication of Mpesa anywhere besides Kenya due to the banking sector protecting its interest?

Opportunity lost

Right now anyone in Kenya can do every type of transaction within our own borders, and if creative into neighboring countries as well. A few other countries have the ability to do this type of thing as well, if less efficient and/or elegantly conceived.

Currently opportunity is lost by local merchants in not integrating mobile payment structures better into goods and services offered to both businesses and the public. This is changing, businessmen are quick to move to figure out new ways to increase margins and customers. It’s only held back by the operators not willingly opening up their platforms for easier integration into business.

11% of Kenya’s GDP was shifted through Mpesa in 2009, and the company expects that to be around 20% this year.

We can all agree those are big numbers and that a massive ability to make money has been shown in Kenya. This begs two questions:

- Why has no one allowed it to truly replicate in another country?

- Why is no one throwing big money after this, trying to figure a way to scale a mobile operator and bank agnostic payment solution across a region, if not the whole continent?

There are big players trying to break into the greater African market (I’m looking at you Naspers). There are banks who have the money to spend on figuring this out, but aren’t thinking beyond their own brand, so continue to fail. Maybe the answer is we just should sit here and let all this lost opportunity continue to drift by us, waiting on the big credit card players of the world like Visa or Mastercard to make a move.

That’s a fatalistic stance, and I certainly hope it’s not true. Unfortunately, I don’t think we’ll see this service come from 2 guys coding in a garage. Instead, I hope that there are mobile operators and banks banding together to make something bigger than themselves that make more profits for everyone. If not them, a big investor willing to wager millions of dollars on making billions.