There’s an good post over at the CGAP blog about mobile money’s innovation crisis. The author claims that nothing new has happened in mobile money since Mpesa was launched in Kenya, except for maybe the launch of Mkesho this year in Kenya as well. Besides that, everyone around the world pretty much tries to duplicate what Safaricom is doing in this space.

Why?

“There may also be one partnership in particular that could be hampering innovation—that with the banks. Historically, these two players have taken very different strategies for new product development, especially in resource poor countries.”

Thinking big picture

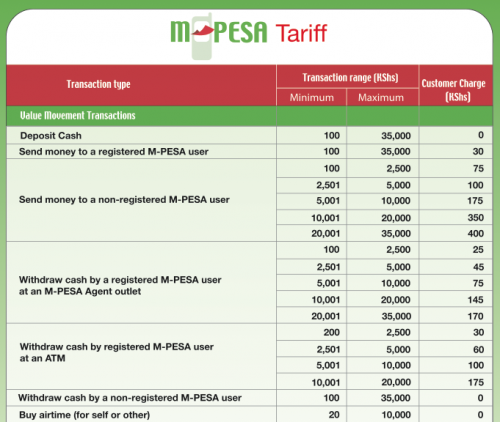

You can send up to $500 for as little as 37 cents using Mpesa. On Zain it will cost you 74 cents. That’s an insanely low transaction cost compared to what banks charge, and that’s not even going into the fact that they can’t do transactions as low as 50 to 100 Ksh ($.60 to $1.24). The kicker, you can store your money in it for no fee at all (unlike the usurious rates that the banks charge).

Simply put, banks cannot compete with mobile operators when it comes to transacting payments for the majority of Africans.

Regulators make and enforce the rules around everything. How do they make their decisions, who lobbies them and why? Is the reason that we haven’t seen a true replication of Mpesa anywhere besides Kenya due to the banking sector protecting its interest?

Opportunity lost

Right now anyone in Kenya can do every type of transaction within our own borders, and if creative into neighboring countries as well. A few other countries have the ability to do this type of thing as well, if less efficient and/or elegantly conceived.

Currently opportunity is lost by local merchants in not integrating mobile payment structures better into goods and services offered to both businesses and the public. This is changing, businessmen are quick to move to figure out new ways to increase margins and customers. It’s only held back by the operators not willingly opening up their platforms for easier integration into business.

11% of Kenya’s GDP was shifted through Mpesa in 2009, and the company expects that to be around 20% this year.

We can all agree those are big numbers and that a massive ability to make money has been shown in Kenya. This begs two questions:

- Why has no one allowed it to truly replicate in another country?

- Why is no one throwing big money after this, trying to figure a way to scale a mobile operator and bank agnostic payment solution across a region, if not the whole continent?

There are big players trying to break into the greater African market (I’m looking at you Naspers). There are banks who have the money to spend on figuring this out, but aren’t thinking beyond their own brand, so continue to fail. Maybe the answer is we just should sit here and let all this lost opportunity continue to drift by us, waiting on the big credit card players of the world like Visa or Mastercard to make a move.

That’s a fatalistic stance, and I certainly hope it’s not true. Unfortunately, I don’t think we’ll see this service come from 2 guys coding in a garage. Instead, I hope that there are mobile operators and banks banding together to make something bigger than themselves that make more profits for everyone. If not them, a big investor willing to wager millions of dollars on making billions.

August 19, 2010 at 4:18 pm

I’m looking from the outside in and really hope local take this opportunity. Good post.

August 19, 2010 at 11:33 pm

Hi Erik, I think the key factor to MPesa’s success is its quasi-monopoly situation in Kenya. With 80% of market shares, the need for the ability to do off-net transactions is considerably lower.

Senegal is, to my knowledge, among the countries with the highest mobile population and revenue o the continent, the only one with a comparably dominant telco, with Orange (70% + of market). Orange Senegal has just recently launched its mobile money solution (last May). They’ve been off to a relatively good start, and it will be interesting to see how they fare.

I do agree that an agnostic player is needed for other markets, and that current big players such as Visa, Western Union or PayPal are probably best equipped to close the gap.

August 20, 2010 at 2:27 am

That’s an interesting theory Alex. I guess we’ll see how far Orange Senegal gets with their solution. Do you know if it’s just payments/transactions, or is it tied to a bank?

August 19, 2010 at 11:52 pm

The number 1 supermarket chain in the UK has just entered the mobile market with very competitive offerings. As it already has a financial services arm (and is therefore regulated by the UK’s Financial Services Authority), I can see m-pesa type offerings coming to the UK in the not too distant future and that day can’t come soon enough for me. Perhaps Nakumatt could do likewise in Kenya.

August 20, 2010 at 3:22 am

The service is essentially payments/transfers, with a few interesting ‘plugins’ such as a partnership with the leading Senegalese e-store, making it possible for people without a credit card (ie the vast majority) to order items.

The service is not tied to a bank from a user perspective, but their strategic partner is BICIS, a local subsidiary of BNP Paribas. The partnership was initiated at Group level, as both Orange and BNP are French. BICIS takes care of the purely financial aspects of the project, including regulatory aspects with the Central Bank of West African States. Orange is the project lead.

For more details, here’s a good interview the head of the mobile money department at Orange gave when they launched a few months back: http://www.itnewsafrica.com/?p=7421

August 20, 2010 at 5:14 am

Eric,I agree with alex.The next level even in kenya will be an agnostic solution. Number portability is coming, no one will want to tie their money to one operator.

The other disease is “brand lock” with banks, telcos etc limited to enhancing their own brand. Last i checked the color of money (revenue) is the same.

August 20, 2010 at 5:29 am

Mbugua, agreed, especially about the dangers of brand locking.

Alex, thanks for the link and the overview. Very helpful.

August 20, 2010 at 3:17 pm

I think the example you used of transferring $500 with MPESA as an example of MPESA’s cost effectiveness is somewhat misleading – most people transact small amounts say 200ksh and 500ksh at those levels of transactions MPESA get’s quite expensive.

What i find intriguing is that almost all bank account holders nowadays are issued with a debit card, now bank acct holder may not be as numerous as cellphone users but with the agressive expansion thats happening in the markt they may not be far – basically debit cards here can only be used at ATM’s and big supermarkets – that to me is an opportunity for someone to exploit.

Banks are all trying to figure out how to work with mpesa – which is good but forgetting they have a product/platform that they can extend with creativity.

Anyway i strayed a little to your core question, i think the main problem as i see it is that banks and most big businesses here,even the Safaricoms and Zains buy technology, they buy finished products – the only R&D they have is market and consumer research. So someone has to develop a solution out there and sell it to the banks or telcos.

August 20, 2010 at 3:28 pm

@Louis, that’s why I included the image with the full tariff list, though you’re right, I could have said 100-35,000Ksh in the post itself. Regardless if it’s more expensive per shilling to transfer that way, you have to remember that you can’t even do that little of an amount with the banks.

Agreed on the software issue. It can be built here, locally, instead it’s usually an outside product shoe-horned into an African market. Many times missing the nuances of the local needs.

August 20, 2010 at 10:00 pm

I disagree with two things here:

1. The headline that Banks are blocking innovation – In Nigeria we are working closely with Banks to achieve the goals of financial inclusion. In fact I would argue that Banks have more incentive for that than Telcos. Telcos are in mobile money to improve their ARPU on the voice/data business not to bring financial services to the base of the pyramid.

2. The post seems to suggest only banks and telcos are able to make mobile money happen in a big way. If Google was started by two guys in a lab at Stanford and working out of a garage, why can’t mobile money?? In a fragmented Telco market the Telco has no advantage other than cash to deliver the value of mobile money. As we have seen in Africa only where a Telco has dominant monopoly has their mobile money scheme been effective – M-Pesa is the example. In fragmented telco markets, you need a multi-stakeholder approach. Only a 3rd party can effectively bring all the various players together to achieve that.

Finally I’d posit that a 3rd party solely focused on mobile payments is more likely to innovate on this business and leave technology aside to actually deliver a vision.

Check out the article we wrote on the topic of multi-stakeholder or go alone approach: http://www.pagatech.com/news/mobile-payments-compete-or-collaborate

Paga is a multi-stakeholder mobile payments service in Nigeria.

August 21, 2010 at 8:11 am

Great post, Hash, thank you for bringing it forward from the original CGAP post that had me a tad uneasy when reading it but couldn’t put my finger on why.

While there’s a lot to be said on this whole topic, here are some thoughts that come to mind immediately, based on your post and also all the informative comments in the conversation.

First,

Currently opportunity is lost by local merchants in not integrating mobile payment structures better into goods and services offered to both businesses and the public. This is changing, businessmen are quick to move to figure out new ways to increase margins and customers. It’s only held back by the operators not willingly opening up their platforms for easier integration into business.

This is one key point – the need for more appropriate and relevant business models and payment plans for commerce in everyday life, given the rapidly changing situation regarding the mechanisms of money transfer (and perhaps even the meaning of “money” itself etc) I believe that there’s great potential right here and right now in this space (hence my ongoing work on the “prepaid economy” http://nitib.wordpress.com) to maximize the potential of the current operating environment itself even as we wait for changes to take place or obstacles to progress be eventually overcome (that is, we’re not sitting around waiting for operators to wake up and smell the coffee)

Second,

Kenya got lucky in that the service mPesa came first and only after the banks and authorities realized its success and spread so any regulations or restrictions came after the fact. The challenge in a country like India for example is that the RBI has already regulated how mbanking should or should not happen and it would be interesting to see what progress is made on mobile platform based financial tools there. The Phillippines as a third comparative example of this evolutionary space is also different and interesting in its own right. What is happening there with GCash and how are the local telco’s looking at product development and services in this space? Finally and most ironically, South Africa and Wizzit, the grandfather of all this – where are they now and what’s happening there?

Given all these disparate operating environments and regional solution/regulations, it would be interesting to map a comparitive study of services vs bank role vs mobile operator role in each of these in order to see who or what is really helping or hindering progress, don’t you think?

Third,

On the topic of operator brand/unwillingness to open up etc that many have brought up in the comments, I have begun to think that perhaps the way forward for effective and scalable solution finding might be the jugaad or workaround way. You know, instead of waiting around for the various blocks and walls to come down, what if we considered them our constraints and criteria for bounding a solution space and then proceeded to evaluate what could be done and how to go about it? Apply a little native ingenuity in face of challenging or adverse conditions so to speak ;p

I might be talking through my hat here in this quick off the cuff the post but I do believe that changes and solutions can be made to happen if we were able to look at the whole problem space with a different perspective than currently (the frame of reference or perspective that led to the article’s PoV that’s the see of this conversation)

Just my tuppenceworth for now, thanks again for starting this conversation…

August 21, 2010 at 8:17 am

Simply put, banks cannot compete with mobile operators when it comes to transacting payments for the majority of Africans.

And more importantly, as far as I know/can tell, the bank charges themselves in proportion to the amounts usually saved/transacted have been such that many at the BoP or on irregular incomes have found negative balances on their savings over time (plus not comprehending why banks charge the way they do and for what they do) so just tend to stay away from the whole institution altogether. Mobile operators otoh have an understood and established presence through the daily transactions and usage and patterns of airtime budgeting and management, thus perhaps why the barriers to adoption and understanding were lower when it came to associating the phone/airtime with finances/spending/saving etc

September 15, 2010 at 10:03 am

Do you think there are taxation compliance issues moving from cash based economies to highly visible transactions models which might influence adoption rates?

January 15, 2011 at 3:13 pm

It’s nice innovation. All it’s require is to build confidence,safety and guaranty of the transactions in peoples mind. It’s a welcome development whereby it’s restricty cash holding. I will apprecite to be part of the machinery to promote this development if posible.