Somalia is intriguing. Since they 7th century they’ve been refining and working within their Xeer system of community law and have a violent aversion to the authority of any centralized government. It’s also one of the most entrepreneurial, hard-edged business cultures around. For instance, there are currently 7 mobile operators, offering better and more varied services (at lower prices) than almost any other country in the region.

Why I’m interested in Somalia is two-fold. First, I’m interested in watching how the international community tries to force central government on a society that clearly abhors it and functions without it. Second, Somalia is a fascinating study for anyone watching the African tech and business scene. Out of one of Africa’s harshest environments, entrepreneur’s thrive.

Hawala (money lending) and remittances

Somali’s have been using the Hawala form of money transfer for centuries, to the tune of approximately $1.6 billion annually. Somalia, per capita, has one of the largest diaspora populations in the world. One in eight Somali’s live abroad. Therefore, it’s not surprising that the remittances they send make up approximately 40% of urban household income, averaging out at $132/per.

(sidenote: my ongoing thoughts are that it is no longer a digital divide solely between rich/poor in Africa, but between urban/rural)

While the political ramifications of Hawala are hugely important and interesting in the post-9/11 world, what I find more pertinent are the mechanics and how technology is changing the way it works.

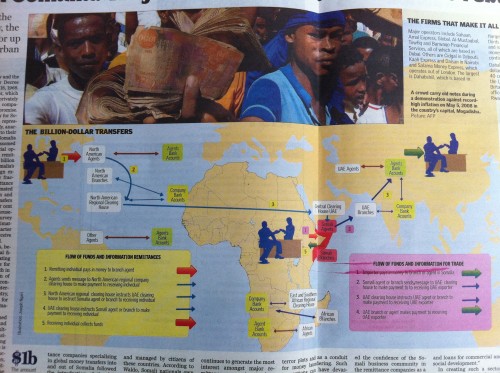

The East African newspaper put out a good visualization today on the way that Hawala currently operates in the form of remittances from Western nations to the Middle East and finally to Somalia. The United Arab Emirates (UAE) serves as a central clearing house for both simple cash transfers and more complicated import/export relationships.

As can be seen, the person in the US or Europe gives money to a branch agent in their country. This is sent to a central country clearing house, then onto a UAE clearing house, then to a Somali agent and finally to the individual who collects the funds in Somalia.

It used to be that Somali local private operators could only communicate by HF radio (yes, they did it before this via trust networks, family ties and paper), but when the mobile phone revolution hit Africa in the 90’s the communications were made more efficient. At first this was through satellite phones, and now by the robust local mobile phone network.

Banks and Hawala

“Modern banks will always ask lots of questions and ask you to fill in lots of forms, our people are used to Hawala, we know it very well.” (via BBC)

There are no commercial banks in Somalia. The country’s relationship with international creditors has been frozen for over 20 years and has a national debt of $3.3 billion, of which 81% of that is in arrears. It’s safe to say that no one is going to lend money to Somalia anytime soon.

The most attractive economic growth would seem to stem from Hawala organizations opening up arms that do commercial, formal banking. Wealth generation without the ability to access debt and credit is more difficult than if you have those tools available – for businesses and for individuals.

I just got back from Mombasa, and there are large amounts of money being imported into Kenya and invested, both at the coast and in Nairobi. Somali’s have clearly shown their enterprise ability and entrepreneurial spirit, there are great swaths of the city that are almost 100% Somali owned now. However, until the communities there figure out a way for life and business growth to be more tenable, the investments will continue to flow to Somalia’s more secure neighboring countries rather than building their own.