Somalia is intriguing. Since they 7th century they’ve been refining and working within their Xeer system of community law and have a violent aversion to the authority of any centralized government. It’s also one of the most entrepreneurial, hard-edged business cultures around. For instance, there are currently 7 mobile operators, offering better and more varied services (at lower prices) than almost any other country in the region.

Why I’m interested in Somalia is two-fold. First, I’m interested in watching how the international community tries to force central government on a society that clearly abhors it and functions without it. Second, Somalia is a fascinating study for anyone watching the African tech and business scene. Out of one of Africa’s harshest environments, entrepreneur’s thrive.

Hawala (money lending) and remittances

Somali’s have been using the Hawala form of money transfer for centuries, to the tune of approximately $1.6 billion annually. Somalia, per capita, has one of the largest diaspora populations in the world. One in eight Somali’s live abroad. Therefore, it’s not surprising that the remittances they send make up approximately 40% of urban household income, averaging out at $132/per.

(sidenote: my ongoing thoughts are that it is no longer a digital divide solely between rich/poor in Africa, but between urban/rural)

While the political ramifications of Hawala are hugely important and interesting in the post-9/11 world, what I find more pertinent are the mechanics and how technology is changing the way it works.

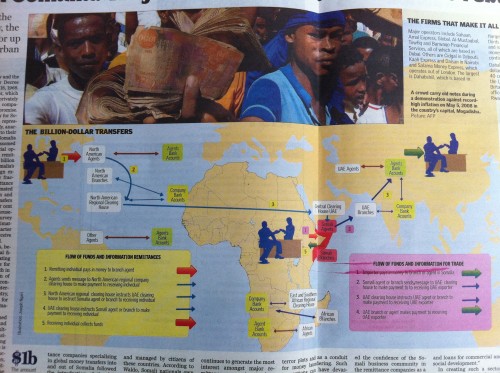

The East African newspaper put out a good visualization today on the way that Hawala currently operates in the form of remittances from Western nations to the Middle East and finally to Somalia. The United Arab Emirates (UAE) serves as a central clearing house for both simple cash transfers and more complicated import/export relationships.

As can be seen, the person in the US or Europe gives money to a branch agent in their country. This is sent to a central country clearing house, then onto a UAE clearing house, then to a Somali agent and finally to the individual who collects the funds in Somalia.

It used to be that Somali local private operators could only communicate by HF radio (yes, they did it before this via trust networks, family ties and paper), but when the mobile phone revolution hit Africa in the 90’s the communications were made more efficient. At first this was through satellite phones, and now by the robust local mobile phone network.

Banks and Hawala

“Modern banks will always ask lots of questions and ask you to fill in lots of forms, our people are used to Hawala, we know it very well.” (via BBC)

There are no commercial banks in Somalia. The country’s relationship with international creditors has been frozen for over 20 years and has a national debt of $3.3 billion, of which 81% of that is in arrears. It’s safe to say that no one is going to lend money to Somalia anytime soon.

The most attractive economic growth would seem to stem from Hawala organizations opening up arms that do commercial, formal banking. Wealth generation without the ability to access debt and credit is more difficult than if you have those tools available – for businesses and for individuals.

I just got back from Mombasa, and there are large amounts of money being imported into Kenya and invested, both at the coast and in Nairobi. Somali’s have clearly shown their enterprise ability and entrepreneurial spirit, there are great swaths of the city that are almost 100% Somali owned now. However, until the communities there figure out a way for life and business growth to be more tenable, the investments will continue to flow to Somalia’s more secure neighboring countries rather than building their own.

October 3, 2010 at 2:03 pm

Some quick notes…first, the Hawala system is in itself a commercial bank. You can find creditors easily through contacts with hawala owners and you will be loaned money if somebody can guarantee it on the other side. Second, I chuckled when you said nobody gives money to Somalia; foreign governments are giving money to Somalia. And now there is a little more paperwork (i.e. show your ID) because of heat from the US Treasury’s financial/terrorism crimes agency. Prior to 9/11, you didn’t even need to tell them your real name (lots of Somali’s have nickname) and everybody was cool with it. Good post.

October 3, 2010 at 2:22 pm

@Joe thanks for the corrections. My understanding of Hawala was that it was a network, not an entity. That each operator could do as they chose. Is that right/wrong?

October 3, 2010 at 2:31 pm

Nice post.

What will be interesting to watch is that the hawala company with the largest market-share has opened a telecom company this year serving Somaliland. They have invested heavily in the venture. Very close to the time they announced they were opening that venture, the telecom company with the largest market-share here in Somaliland opened their mobile payment system, which operates basically the same system as M-Pesa.

Both seem to be vying for the what will likely be the Somali Financial Services Holy Grail – think Pay-Pal + Hawala + M-Pesa. Prior to last year each of these companies were nearly monopolistic within their sector. Now they have entered each other’s sector and the competition has further driven down prices and up services.

And, by the way, the largest of the Hawala companies has (as you suggest) opened a formal arm based in Djibouti with announced plans to extend into Somaliland.

October 4, 2010 at 4:30 am

I quite enjoy reading this blog and didn’t bother to comment since it’s so well-written and informative of what’s happening around the East African region which i so dearly miss, sentiments aside, i would like to correct one more thing, the Hawalas work more like a transfer bank like Western Union not like a bank, they can’t handle large sums of money, credits and loans are offered by rich business men to their next kin and whom they can trust, most of the businesses are informal. The only Id they ask is your clan and some elder guy who can confirm if you are from that clan, its abhorrent and i hate using that old system if you know what i mean.

October 4, 2010 at 9:43 am

first the statistics… i think that 1.6 billion quoted in that article is western union, which is misleading because, hawala is much bigger and operates in competition to western union….

most rich somalis have moved their property to nairobi and mombasa and other towns, in kenya precipitation huge asset price inflation…. not all the cash is clean….

the hawala system is based on trust, in some places no money mioves physically , and all it takes is a phone call from one agent to another…

October 4, 2010 at 5:08 pm

Yes, next to the macro impact a system like Hawala / Al-Barakat has on an economy, I’m also fascinated that it is based on trust.

The only other system I can think of that works this way are the Dabbawalla food transports in Mumbai.

I am very curious to know where Somalia will be in let’s say 15 years from now, compared to other countries in the region – and how it will be influenced / depend on these remittances.

October 19, 2010 at 10:54 pm

@Hash great article and much needs to said about the determined folks rendering great the service for the people of Somalia and surrounding countries. The Hawala system is a network and a bank in Somalia. The 3 largest Hawala are Dahabshiil, Amal and Qaran Express. In fact in Djibouti Dahadshiil runs a commercial bank. Amal and Dahabshiil have large operations in Kenya when you get back go see the investments they are making in Eastleigh, Nairobi. No Kenya government has made such investment in that neighborhood and wish they at least fix the road.

In Hargeisa, Somaliland Dahabshiil is the defacto bank and they even have plastic debit cards!! When a small player wanted to get a MPESA like system started in Somaliland the Wireless Teleco crushed them and guess who backed them up by starting a new wireless mobile company – Hawala operators!! In Northeastern Somalia the largest Hawala operator is Amal and they finance everything practically. The Hawala is and will always operate on trust however since 9/11 they have been burdened by paperwork and US and European banks harass them. They are an inventive bunch so to overcome this now they are pooling resources in the US and would become a bank and have an operation Minneapolis, MN where majority of Somali live in the US.

From technology perspective you are right they have evolved greatly from complete trust (still works in Somalia and surrounding countries) to complete data driven system with automated SMS confirmation when money is received by intended customer.

Banks and Telecom used to be different verticals but this is no longer the case in Somalia and increasing in the whole East Africa.