I get asked a lot about mobile data costs in East Africa, so thought I would put it in writing for everyone to find easier.

I get asked a lot about mobile data costs in East Africa, so thought I would put it in writing for everyone to find easier.

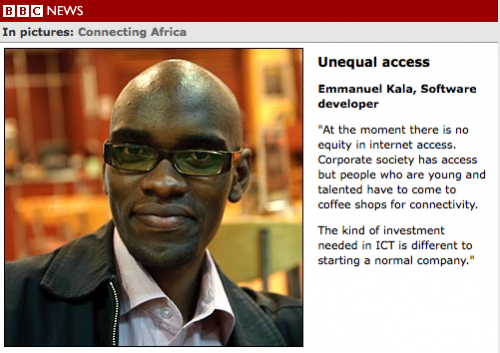

Mobile data access charges have fallen drastically in the last several years in East Africa, in large part to the SEACOM undersea cable arriving and increased competition between operators. Data connectivity is the new battleground, fighting not just amongst mobile competitors, but also with traditional ISPs.

In the mobile data connectivity space, each country sells either data capped bundles (or time capped bundles in the case of Uganda) that can be loaded onto a SIM card. There are out of bundle charges, priced per Megabyte or Kilobyte, but these rates are exorbitant, so anyone who connects regularly uses a bundle of some sort.

More creative offerings come out each month by the mobile operators, making it more confusing and harder to compare against competing services, but also offering some incredibly low pricing for entry-level users, or consumers who don’t need high speeds.

No doubt, a downward trend of mobile data charges will spur the growth of mobile web usage and publisher forwards.

Kenya

In Kenya, from charging internet usage at 10 shillings a minute just a few years ago, now cyber cafes charge 1 shilling a minute for browsing. The use of mobile data has been made easier by increasingly cheaper rates. For example in Kenya, Safaricom are offering a limited 10MB worth of mobile internet usage at 8 shillings per day. Zain Kenya offers unlimited internet usage for 3,000 shillings per month. Orange Kenya on the other hand are having a 7-day unlimited offer for their 3G network at 1000 shillings.

Uganda

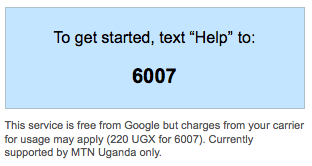

In Uganda costs for mobile data connectivity have been driven down by the SEACOM cable landing in 2009, and led by costs cutting by Orange. Orange was first to the market with cheap, affordable 3G service and has played a major role in driving market prices down. They were the first to institute 5,000Ush/day & 25,000Ush/week packages for Internet – finally making it accessible to the common man. MTN, the larger network in Uganda,

Tanzania

Tanzania boasts some of the most unreliable data networks with the least penetration within East Africa. Zain and Vodacom both offer 3g, while Tigo offers GPRS. Zantel and Sasatel are CDMA networks, with EVDO connectivity. All networks, no matter what the speed of the connection, charge a flat rate of 40,000Tsh for 1gb of data. Data prices have gone down, but not noticeably.

While not possible to do an apples-to-apples comparison of the rates between the three countries, here is a pricing comparison chart for 3g data on 1Gb bundles and 1Mb pay as you go costs for the leading operator in each country:

| Kenya (Safaricom) |

Tanzania (Vodacom) |

Uganda (MTN) |

||

| 1Gb of 3g data (bundle) |

2500 Ksh | 40,000 Tsh | 49,000 Ush | |

| USD equivalent | 1Gb of 3g data (bundle) |

$30.90 | $26.56 | $21.63 |

| 1Mb of 3g data (Pay as you go) |

8 Ksh | 120 Tsh | 900 Ush | |

| USD equivalent | 1Mb of 3g data (Pay as you go) |

$0.10 | $0.08 | $0.40 |

As is true in this hyper competitive market, these numbers will change (hell, I’m probably already off on something). The overriding trend is that the costs are going down for consumers, even if slower than we’d all like to see.

[Picture courtesy of Stefan Magdalinski]