There’s quite a good read up on the Tech Coctail site titled, “What (US) VC’s Are Missing in a Rising World of Smartphones“. It’s a little about smartphones, though the underlying discussion points are really about how blind the investors in the West are to the Middle East, Africa, and Asia due to their preconditioning on Silicon Valley being the only place that big tech things happen. Meanwhile, massive deals are ongoing in the Middle East and Asia that are under the radar.

There’s quite a good read up on the Tech Coctail site titled, “What (US) VC’s Are Missing in a Rising World of Smartphones“. It’s a little about smartphones, though the underlying discussion points are really about how blind the investors in the West are to the Middle East, Africa, and Asia due to their preconditioning on Silicon Valley being the only place that big tech things happen. Meanwhile, massive deals are ongoing in the Middle East and Asia that are under the radar.

But Western VC’s are slow, and US VCs in particular are slow to catch on to this trend. In part, this is because US investors are accustomed to seeing the best US deals, and they are used to dealing with our ecosystem, our rule of law, the network effect of talent that is Silicon Valley, and other places here that are attracting dollars accordingly.

After spending 3 months raising investment for the BRCK company in the US, EU and Africa I can confirm that there is a great deal of investor unease in putting money into something in Africa from the US. Silicon Valley types tend to pay lip service to this idea, but don’t actually invest their money that easily.

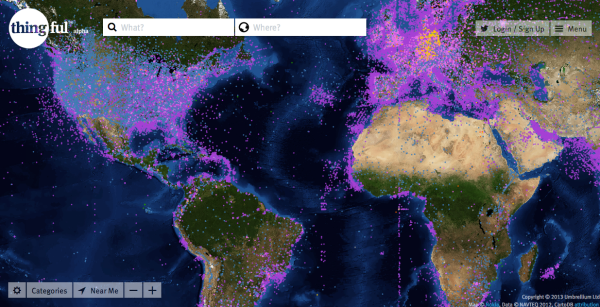

I just wrote a post on the BRCK blog about what Juliana brought up at TED last year about “unequal distribution”, this time shown on a world map of the internet of things. This idea of unequal distribution of information and how it played into the industrial revolution, the scientific revolution and now the digital revolution that we’re sitting in today.

Thingful.net – mapping the internet of things

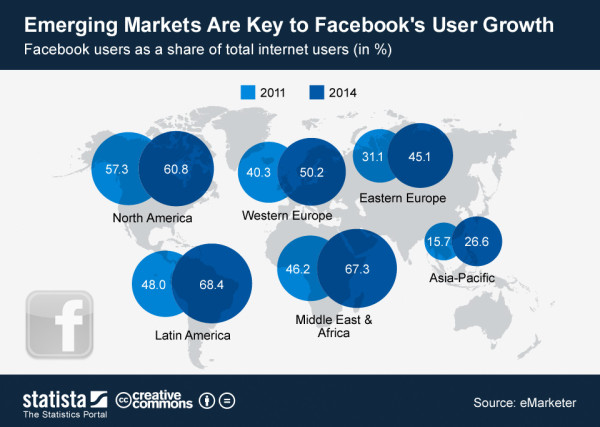

Unequal distribution is not static, it’s a constant dynamic where no one region of the world will lead indefinitely. ITU stats already point out that 65% of the people who get onto the internet today come from emerging markets. Meanwhile, only 24% of the people in emerging markets are online. That means that whether the West realizes it or not, the internet focus has already shifted, the ripples of this are only now being felt.

If you think that Google’s, Yahoo’s, Cisco’s, Intel’s (and many other’s) partnership in the Alliance for Affordable Internet and Facebook’s Internet.org strategies around global internet connectivity are just CSR activities, then you’re sorely mistaken. These companies (literally) see the numbers and the know that they need to stake a claim in the regions where the future of the internet already are.

Where Facebook’s users are coming from 2012 vs 2014

April 7, 2014 at 9:11 am

The same goes for Payments, VISA/MasterCard are seeing in Markets like Asia and CEMEA are growing electronic payment volumes by over 22% CAGR. Whilst the US/ Europe are at 4.5% CAGR – majority of the people making their first e-money transaction are coming from the Emerging Markets

April 7, 2014 at 9:14 am

Interesting info @SVH – didn’t realize that the growth differences were so drastic on electronic payment volumes

April 7, 2014 at 9:12 am

The data point above is from Cap Gemini

http://www.capgemini.com/resource-file-access/resource/pdf/wpr_2013.pdf

April 7, 2014 at 11:32 am

Have you tried raising money in India? They have similar problems. Will probably have better appreciation for the product’s potential.

April 8, 2014 at 9:58 am

100% agree with the points that you are making, especially the last point about companies that see the growth potential around global connectivity. Such an exciting time, and perhaps one of the ways our generation can impact the world. Have you thought about collaborating with the Internet.org partners? BRCK could be an interesting part of the connectivity chain.

April 8, 2014 at 10:10 am

Hi Sam, yes we’re talking with the Internet.org team about last-mile connectivity.

April 8, 2014 at 11:48 am

Fantastic- hope you’ll share what you can in due time. 🙂 Hope all’s well and that our paths cross again soon. It’s been too long!