Becky Wanjiku sits on the iHub Advisory Board with me, and started a discussion on the iHub, asking “What has the iHub Achieved?“. Her main takeaway point being that the iHub is a platform, and it’s what YOU do with it that is important. T

he iHub started in March 2010, so it’s been about 3.5 years and a lot has happened here in the intervening years. Many people ask me, “so, what has the iHub done?” The best way I could think of to answer that is to just list as much as I could think of, so here’s a rather exhaustive list, though I’m sure that I’m missing some things.

Why Tech Hubs in Africa Exist

Nairobi tech community working at the iHub, circa 2011

Before I get into that though, maybe a framing on why tech hubs exist is important. They’re not just there for startups, in fact our thoughts on incubation and products going back to 2010 was just pre-incubation and connecting to other businesses and investors. Places like the iHub exist to connect this community together, while we get involved in other gaps that exist in the market (UX, incubation, research, etc), these are just part of providing a place where serendipity happens for those who are involved across the network.

These spaces are more than just nurturing talented entrepreneurs, and to not see that means you’re missing the bigger picture on why they exist. They’re not only about entrepreneurs, though we have seen some of them grow from nothing to 40-person orgs that run across multiple countries.

The tech hubs in Africa are more than just places focused on products, much of what goes on is about connecting the people within the tech community in that area to each other and to the greater global industry. For instance, we started Pivot in East Africa, an annual event that does two things: First, it created a culture where the entrepreneurs learned how to pitch their products. Second, it gave a reason for local and global investors and media to come and see what’s going on. Both funding and media coverage have resulted.

Another example is the connecting of global tech companies to local developers, the training that comes out of it for everyone from network operators to Android devs. Google, Samsung and Intel all play strongly in that space.

Some work at increasing the viability and skillsets of freelancers. Whether they’re web designers or PHP software engineers increasing their understanding of how to setup a company, know what IP law is about, take training on project management or quality assurance testing – these all add up to a community that is evolving and becoming more professional.

Those are just a few of the things that tech hubs do across Africa. I can speak for the iHub in Kenya, but know that there are others such as ccHub in Nigeria, Banta Labs in Senegal, ActivSpaces in Cameroon and the other 19 tech hubs in the Afrilabs network are all doing amazing things that create a base for new innovative products, services and models to grow out of. There are new models for ecosystem development around tech in Africa revolving around these technology hubs that are, and will breed, more innovation over time.

New initiatives and organizations from the iHub:

m:lab – first tech incubator in Kenya (2011)

Mobile testing room – all the tablets and phones from the manufacturers (2011)

iHub Research – tech focused research arm (2011)

UX Lab – first user experience lab in East Africa (2012)

iHub Consulting – an effort to connect freelancers to training and businesses (2012)

Savannah Fund – a funding and accelerator program (2012)

Cluster – first open supercomputer cluster in East Africa (2013)

Gearbox – an open makerspace for rapid prototyping (2013)

Code FC – iHub Football Club

Volunteer Network team – the iHub internet network was setup, and is run by, volunteers

Startups who met, work, or started in the iHub:

BitYarn

NikoHapa

KopoKopo

M-Farm

BRCK

Eneza Education

Ma3Route

Uhasibu

Fomobi

Whive

Zege Technologies

Afroes Games

iDaktari

MedAfrica

SleepOut

M-shop

Angani.co

Wezatele

AkiraChix

Upstart Africa

Juakali

CrowdPesa

Elimu

iCow

Sprint Interactive

Lipisha

6 Degrees / The Phone book

Pesatalk

Skoobox

Waabeh

MamaTele

RevWebolution

Smart Blackboard – Mukeli Mobile

Not all groups start their company at the iHub, but they do meet their future business partners there. The Rupu founders met at an iHub event, and subsequently went on to grow their business, the same is true of companies like Skyline Design, and probably many others who we don’t even know about.

It turns out that serendipity is intrinsically hard to measure.

Larger events, groups and meetings:

One of the 120+ events that takes place at the iHub each year.

- Pivot East – annual pitching competition for East Africa’s mobile startups

- iHub Robotics (now Gearbox community) meet-ups and build nights

- EANOG – East Africa Network Operators Group

- Kids Hacker Camp – 40 kids hack on Arduino, learn about robotics and sensors in a week long full-day hackathon, in partnership with IBM

- NRBuzz – A monthly event on sharing research on new technologies and communication

- Summer Data Jam – an annual 6-weeks training on Research and Data

- Tajriba – month-long user experience event

- m:lab mobile training – 22 students, 4 months, business and mobile programming (2 years to date)

- Legal month – annual event with visiting legal professionals leading workshops

- Barcamp Nairobi (2010, 2011, 2013)

- Waza Experience – volunteer outreach initiative to expose Kenyan youth to technology and spur creative thinking, problem solving, and better communication skills

- Fireside Chats – A session for VIP and seasoned speakers

- Mobile Monday

- Wireless Wednesday

- JumpStart Series

- Pitch Night

- iHub Livewire – music concert by the iHub community

- iHub Research Coffee Hour

- We have a Policy Formulation Team which consists of Jessica Musila, Martin Obuya Paul Muchene, and Jimmy Gitonga. Each one of us sits or has sat through a policy formulation process, such as the AU CyberSecurity (Martin and Paul) and MySociety, Mzalendo (Jessica Musila) and National Broadband Strategy (Jimmy Gitonga).

Outreach events

Egerton University

Catholic University

Kabarak University (Nakuru)

JKUAT (Juja)

Dedan Kimathi (Nyeri)

Maseno University

Nelson Mandela University – Arusha

Strathmore / Intel

University of Nairobi – School of Computing and Informatics

Research-related activities:

Launching of the Data Science and Visualization Lab – 2013

First Summer Data Jam Training – 2013

Research published:

- Digital libraries and crowdsourcing – http://bit.ly/1boQpeI

- The Gap Between Mobile Application Developers and Poor Consumers: Lessons from Kenya. Proceedings of CPRsouth8. September 2013.

- 3Vs Framework for Crowdsourcing. August 2013.

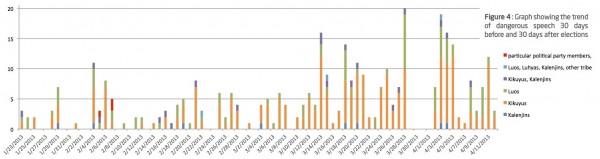

- Umati Final Report June 2013.

- Umati: Kenyan Online Discourse to Catalyze and Counter Violence. IFIP 2013 Conference Proceedings. May 2013.

- Startup Business Models and Challenges for East African mAgriculture Innovations. IST 2013 Conference Proceedings.

- Mobile Phone Usage at the Base of the Pyramid in Kenya. InfoDev World Bank. December 2012.

- M-governance: Exploratory Survey on Kenyan Service Delivery and Government Interaction. IST 2012 Conference Proceedings.

- Increasing Kenya Open Data Consumption: A Design Thinking Approach. Proceedings of ICEGov 2012.

- Meshcasting News in the Port Harcourt Waterfronts. Internews. May 2012.

- Development of Local Educational Digital Content For Schools In Kenya Using The Mobile Device As An Acceleration Tool To Enhance Learning And Facilitate Collaborative Learning

- Growth Of Mobile Education Platforms And The Impact On Learning In Primary Schools In Kenya

List of infographics created (PDF Links):

Mobile Technology in Tanzania: 2011

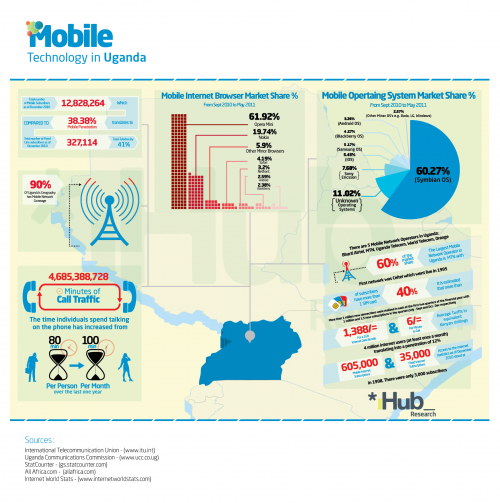

Mobile Technology in Uganda: 2010/2011

Mobile Technology in Kenya: 2010/2011

Kenya Open Data Pre-Incubator Plan: 2012

3Vs Crowdsourcing Framework for Elections: Using online and mobile technology: 2013

How to Develop Research Findings into Solutions using Design Thinking: 2013

Mobile Statistics in East Africa: 2013

iHub Infographic: 2011

Crowdmap Use

Mobile Tech in East Africa: 2011

An Exploratory Study on Kenyan Consumer Ordering Habits

Tech hubs in Africa research (PDF Links):

ICT Hubs Model: Understanding the Factors that make up Hive Colab in Uganda: August 2012

ICT Hubs Model: Understanding the Factor that make up ActivSpaces Model in Cameroon: August 2012

The Impact of ActivSpaces model (in Cameroon) on its Entrepreneurs: January 2013

Draft Report on Comparative Study on Innovation Hubs Across Africa: May 2013

ICT Hubs model: Understanding the Key Factors of the iHub Model, Nairobi Kenya: April 2013

ICT Hubs model: Understanding Factors that make up the KLab Model in Rwanda: April 2013

ICT Hubs model: Understanding Factors that make up the MEST ICT Hub – ACCRA, Ghana: April 2013

ICT Hubs model: Understanding Factors That Make Up Bongo Hive, Lusaka Zambia: April 2013

ICT Hubs model: Understanding Factors that make up Kinu Hub Model in Dar es salaam, Tanzania: April 2013

Key partnerships:

- Intel

- Wananchi Group – ZUKU

- SEACOM

- Samsung

- Microsoft

- Nokia

- Qualcomm

- MIH

- InMobi

VIP speakers:

- Michael Joseph, Safaricom

- Joseph Mucheru, Google

- Vint Cerf, Google

- Stephen Elop, Nokia

- Marissa Mayer, Yahoo

- Bob Collymore, Safaricom

- Larry Wall, Creator of Perl

- John Waibochi, Virtual City

- Mike Macharia, Seven Seas

- Ken Oyola, Nokia

- Isis Ny’ongo, Inmobi, Investor

- The tweeting Chief Kariuki

- Louis Otieno, Microsoft

- Dadi Perlmutter, Intel

- Susan Dray, Dray and Associates