Bankers are not well known for giving riveting talks. However, Stephen Mwaura Nduati gave a surprisingly interesting one here at the Mobile Banking conference just outside Nairobi. He’s in charge of “Payment Systems” at the Central Bank of Kenya – a regulator.

He made the case for why regulation is needed, and what risks are naturally inherent within payment systems. Not just mobile payments, but all systems.

What I was most interested in was his slides giving out some data on the payment system space within Kenya. It’s really quite revealing on what the motives are, and why they’re there, for the Central Bank and policy makers.

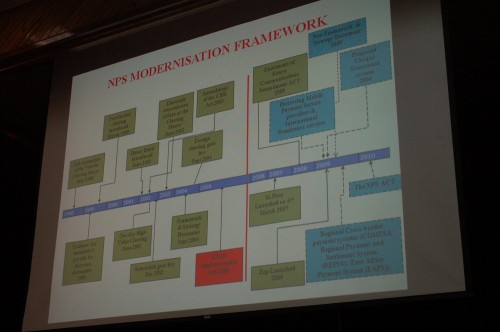

Kenya’s payment system timeline

You can see where Mpesa and Zap came into the timeline for payment systems in Kenya, but you can also see that it’s quite clear that the Central Bank of Kenya (CBK) thinks of many things beyond mobile payments.

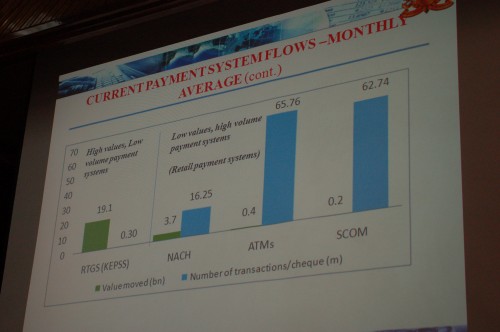

Low vs high volumes

Mobile payments are all the rage, clearly shown in the graph below. However, the amount of money flowing through the system from this is negligible compared to the other types of payments. There is a large difference between high volume systems versus where a lot of money flows, but with fewer transactions.

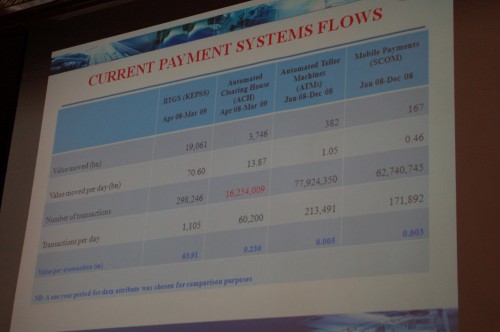

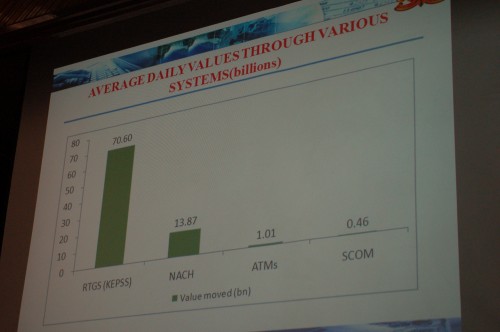

Current payment system flows

Low volume, high value. These are what the CBK care about. Taking a look at the following two slides, you can see that though mobile payments and ATMs are what everyone talks about, what the bank really cares about making sure that the real time gross settlement (RTGS) system stays on the tracks.

May 25, 2009 at 9:11 am

Thanks for that perspective. large payments, cheques , international payments are the core of the banking system, and thats where regulator should maintain focus. The average retail customer had a cheque book, because it was his only option next to paying cash. Now he has a mobile payment option, and doesn’t need to write small cheques (less than $420) anymore (that still take a week to clear) . So the banks are making a mole hill over M-Pesa are doign so because they are losing fees they are not justified in collecting

May 25, 2009 at 11:17 pm

Ah, these numbers regarding mbanking are based on their assumptions, right?

What if…mobile banking was used for transfering higher amounts (just because it works better)?

May 26, 2009 at 3:39 am

I think with the landing of the fibre and more business operations moving to the web in Kenya (slowly but steadily), a online version of mobile cash transfers will be the way to go. And it need not be run by a bank.

May 26, 2009 at 7:38 am

Bank and service provider agnostic platforms is the way to go

May 26, 2009 at 9:22 am

though iam nigerian, working with human right org. CLO in kaduna northwest zone i find this web page very interesting please keep up updating it, and i would close this little one third finish statement by saying i love you, God love you and God bless you.

May 27, 2009 at 2:03 am

I always thought that M-Pesa is something that the banks should embrace rather than fight.

I would like to be able to deposit and withdraw via M-Pesa. So if I receive payments using M-Pesa, I can bank them direct from my mobile phone.

I think that would be beneficial to the banks as it would increase their reach. It would allow many of the current unbanked who are already M-Pesa users to start banking, start building credit histories and perhaps start accessing loan facilities from the banks.

May 29, 2009 at 4:18 am

Hi Erick :this is huge ! spread the word Collins Injera & Humphrey Kayange make IRB player of year 2009 list

May 29, 2009 at 11:02 am

Thanks for introducing a different perspective!

Certainly, the number of transactions and the number of customers carrying them out are very different indicators comared to the total sum of money transfered. I think the M-Pesa system also raises challenging regulation problems. Should (mobile) communication be vertically integrated with banking? It’s an open question.

http://mmd4d.org/2009/05/29/mobile-money-by-m-pesa-a-need-or-a-luxury/

January 18, 2010 at 12:26 pm

Good stats, but does Mama Mboga get access to RTGS? and if she does, how much would it cost her? I support Mpesa because of it simplicity, reach and of course accessibility. The number of transactions tells it all

March 29, 2010 at 6:25 am

Is there a link to the full presentation? In my opinion regulators in general are often several years behind where they need to be and in Africa the tendency for the central banks is to wait for it to be widely done in the western world before jumping on to the bandwagon. But mobile money is really something that promises to be even more revolutionary than the ATM. It means carrying money on your phone rather than lots of paper notes in your pocket. It reduces the wait time that is needed for manually paying at the traditional cash register or swiping at the POS. It has great potential for the African market where vast geographical spaces often are a major cost and constraint. It would make trade a lot easier not just within countries but even between them. Banks and regulators need to understand this fact and accomodate their business around this future reality.