If you’ve been wondering what the numbers look like for Kenya’s mobile and ISP space, look no further than the latest CCK Report (Communications Commission of Kenya). It’s one of the best documents that I’ve seen, compiling information that you just can’t seem to find anywhere else.

Highlights of Q4 2010:

- There are 22 million mobile subscribers in Kenya

- 9.5% mobile subscriptions growth, which is increasing over the previous quarters

- 6.63 billion minutes of local calls were made on the mobile networks

- 740 million text messages were sent

- Prepaid accounts for 99% of the total mobile subscriptions

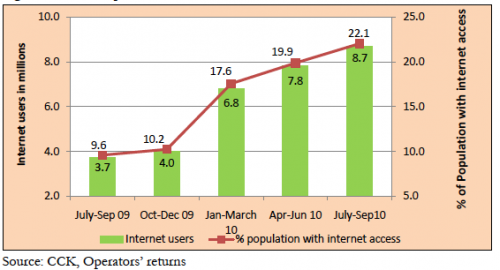

- The number of internet users was estimated at 8.69 million

- The number of internet/data subscriptions is 3.2 million

- Broadband subscriptions increased from 18,626 subscribers in the previous quarter to 84,726

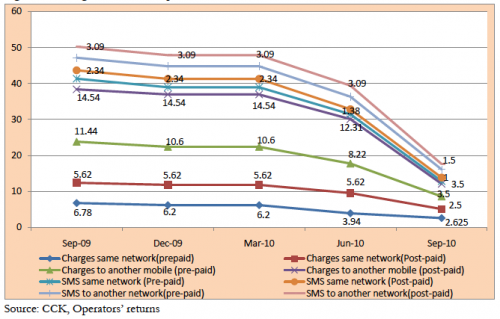

Price Wars

Everyone recognizes the impact on SMS and voice, due to the price wars brought on by Airtel last year. The average, people are paying 2.65 Ksh per minute for voice representing 33.4%

reduction on pre-paid tariffs. It comes as no surprise that there was a 68.4% increase in traffic during this period, nearly triple the norm.

There’s nothing like a chart to bring this point home:

Interestingly, a decline in total number of text messages sent (4% less) was recorded. It’s an indicator that given the choice of lower cost voice, people would rather use that, and they do.

Safaricom lost 4.8% market share, from 80.1% to 75.9% (still massive). Surprisingly, it wasn’t Airtel who benefitied, as Orange made up for most of that with a 4.4% increase of their own. Airtel did lead the market by recording 1,143,353 new subscriptions, about 3x their closest competitor.

Internet

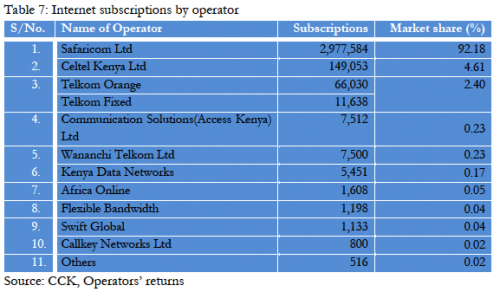

A whopping 99% of the internet traffic in Kenya is done via mobile operators, meaning 3G, Edge or GPRS. It’s to Safaricom’s credit that they moved on this early, not dithering around on data as their competition did, effectively taking the whole market.

My theory is that there are only two major players in the ISP space in Kenya. The first is Safaricom, supported by this report, who will own most of the country due to having an island strategy (mobile towers). This allows them to own all the rural areas and anyone who needs decent speeds and has to be mobile.

The other is the fiber bandwidth provider (ISP) who figures out and cracks the consumer market. The closest to doing this is Zuku (Wananchi) who started rolling out 8Mb/s high-speed fiber-to-the-home internet connections in Q4 2010 at only 3,499 Ksh ($45). These numbers aren’t reflected yet. My guess is that we’ll see Zuku tying up all the home internet connections in the major urban areas.

Estimates for those with internet access in Kenya is closing in on 9 million users, and at over 22% of the population, we can say we’re getting a lot closer to the critical mass needed for real web businesses and services to thrive.

Final Thoughts

Overall, the numbers on both mobile and internet are trending up, and at a very favorable rate. The indicators here prove that you should be paying a lot of attention to mobiles and data connectivity in Kenya.

If you’re a business, what’s your mobile plan? How are you providing and extending your services over the internet (and no, a website is not enough)?

If you’re an entrepreneur, how are you going to use this information to decide what to build? Are you paying attention to the wananchi, building apps for the upper class?

PDF of Report: CCK Report download – Kenya Q4 2010

February 18, 2011 at 5:32 pm

(where’s the flattr/kachingle button for this post? – thx! 🙂

February 19, 2011 at 9:31 am

This is a very interesting report analysis, Erik.

To note though: it’s Airtel that grew it’s share of the Kenyan market by 4.4% from 9.1% to 13.5% and grew their subscriber base by over 62% while they were at it, mainly by attracting close to 60% of the net additions into the subscriber base. Impressive.

Growing the average revenue per user is their next big challenge, though, and it’s a big one especially as it appears that we (may) have reached the peak “minutes of use per subscriber per month.”

Meanwhile, we have to give credit to Safaricom for their foresight with the data strategy. They’re definitely the superhighway connecting Kenyans to the internet.

But, the most impressive statistic of all is the tripling of mobile subscribers from 7.3 million in 2006 to 22 million today. That’s something and three quarters.

February 19, 2011 at 9:42 am

Just to clarify after rereading what i posted: it appears it’s the number of mobile subscriptions that have tripled, not necessarily the number of subscribers. This is an important clarification because there are a good number of Kenyans who have multiple subscriptions from different networks.

February 19, 2011 at 11:56 am

Thanks for sharing, Erik. One thing I’d be curious to know that isn’t covered in this sort of high-level report: what are the demographic & socioeconomic profiles of the mobile Internet users? For example, are they generally young, urban, above average wage earners who are well educated and male? Or is access and utilization more evenly spread across multiple groups? Just thinking out loud…

March 14, 2011 at 1:22 am

Any thoughts about Zuku’s business model? Are they sustainable? Will they run into banwidth issues with continued growth? Just curious.

March 14, 2011 at 2:02 am

Jerry, I think it is sustainable. They’re in that growth stage where they have to grow at a certain rate in order to get to critical mass to offset their lower rates.

September 8, 2012 at 12:27 am

Help us harness the power of the internet with microfinancing at Zidisha! Internet accessibilty in places like Kenya has offered our borrowers the direct P2P lending, reducing interest rates to an industry low of 8.2%

February 5, 2013 at 9:29 am

Where is the largest growth of mobile phone access and internet service taking place in Kenya; in cities or among the youth?