Transacting money to and from Africa comes in a variety of flavors. Generally, besides country-specific solutions, there are: bank wires, Western Union or MoneyGram, buying phone cards in-country that can be resold, cash in a suitcase, mail a check (that will be stolen in the post office), etc.

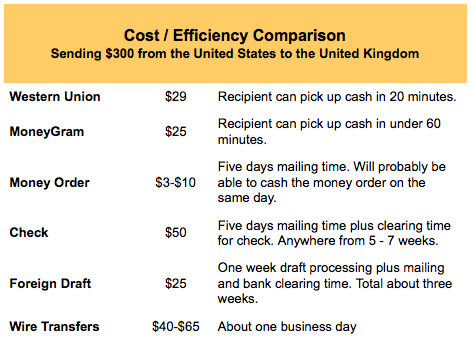

As you can see, there are limited practical ways for getting money transferred internationally on a regular basis. It’s no wonder then, that even with the transaction costs ranging from $15-70, people tend to use the safer, more secure methods of banks, and money transfer businesses like Western Union and MoneyGram. I’ve used all three of these, and over time have started to drift towards MoneyGram as my favorite. They have a cheaper transaction cost than the other two, and I’ve experienced a much easier time with them over the hurdles that Western Union decides to throw in your way.

All this to say, if we consider banks wires a static white-collar service, then MoneyGram is quickly becoming the best option as the common man’s way to transfer money internationally. As such, I’ve been getting deeper into their services, seeing what types of API and digital offerings that they have which could be useful.

Mobile Payments

Currently, MoneyGram has around 180,000 agent locations around the world. More importantly, they’ve just announced that they are set to tackle the mobile payments space by creating relationships with the mobile networks.

“Mobile money transfer services are an emerging part of our product offering and we are eager to bring these services to the Middle East. Overall, we expect mobile service to be in highest demand in developing economies where individuals are more likely to have mobile phones than bank accounts.â€

This is an important point, as it merges two different ecosystems of payments. At the local level, in countries that have the right tools and cultures for them, mobile payment solutions act as transfer services for people within the country. Traditionally, this local mobile payment system is not available for use by those internationally.

Right now MoneyGram’s connection to the mobile payments agents is focused on the Middle East and Asia, my hope is that countries in Africa will soon follow. My guess is that Zain’s Zap service might be one of the first, due to their connection to the Middle East, but no one knows for sure yet.

[Update: Just before posting this I heard about a couple of banks and Western Union in the UK working with Mpesa in Kenya to do transfers via mobile. Others are working hard in this space too, and for good reason, it provides a great deal more usability for end-users on both sides of the ocean. If one entity catches that mindshare, they’ll have a lot more profitability in the space)

October 14, 2009 at 3:50 am

You seem to have missed paypal.

October 14, 2009 at 9:09 am

I’m not sure I follow Wilf. PayPal can’t be received in Africa, and there are indications that they are purposefully closing down accounts that are accessed from the continent, even if it’s owned by someone from the US with a flawless history.

October 14, 2009 at 10:47 am

I find the easiest means of transfer in Cameroon is to access my US bank account from an ATM machine. The ATM’s are sparse, especially in the provincial capital of Bamenda, but transaction costs were typically a mere $1.50 – $3.00.

October 14, 2009 at 10:57 am

@Kelsey – I think it’s safe to say that you’re one of the few people who has a US bank account in Cameroon. The ATM option isn’t the easiest option to receive transactions for everyday Africans, simply due to the lack of bank account in-country, and many times lack of a contact outside the country who will give them an ATM card for their account in that other country.

October 14, 2009 at 11:05 am

That’s very true. It is a very easy option if one does have a US-based account, one that perhaps is owned by a brother or sister living overseas. Very convenient and inexpensive.

October 14, 2009 at 11:08 am

Right Kelsey – it’s a great option for people for those who can do it. Nothing beats it actually.

October 16, 2009 at 2:31 am

ATMCASH only charges $5 every time and has the lowest exchange rates. Why is no one talking about this company.

October 23, 2009 at 5:59 am

Things are moving fast indeed… Seems that soon Kenyans will be able to send and receive abroad as Zap and Safaricom have both plunged into the market. More and more full page advert in Kenyan newspaper…

My question, what about taxes and fees ??

October 24, 2009 at 5:25 am

As we wait for our online money transfer to catch up with the developed countries, cant wait for the mobile transfer to happen… been receiving money through western union wasting my precious time from work .

August 12, 2012 at 4:05 pm

Don’t get so cozy with Money Gram. Recently they’ve decided to step in as the consumer’s mother. I’ve been sending money to my friends in Ukraine for over five years, to help with language lessons, to pay rent/food/lights, and to send my own rent payment on my own apartment to my landlady.

Well, some bright sole at MoneyGram decided that I’m being scammed, so they’ve closed my account and will no longer take my money. I just read on a consumer report blog that it’s been happening to others as well.

It won’t be too long before our nanny state corporations will begin refusing our money at MacDonald’s if they can’t see our belts standing at the counter.

I’d advise that you stick with Western Union. Money Gram’s attorney’s are going to kill their business.