WhiteAfrican

Where Africa and Technology Collide!

Tag: nairobi (page 5 of 7)

Bankers are not well known for giving riveting talks. However, Stephen Mwaura Nduati gave a surprisingly interesting one here at the Mobile Banking conference just outside Nairobi. He’s in charge of “Payment Systems” at the Central Bank of Kenya – a regulator.

He made the case for why regulation is needed, and what risks are naturally inherent within payment systems. Not just mobile payments, but all systems.

What I was most interested in was his slides giving out some data on the payment system space within Kenya. It’s really quite revealing on what the motives are, and why they’re there, for the Central Bank and policy makers.

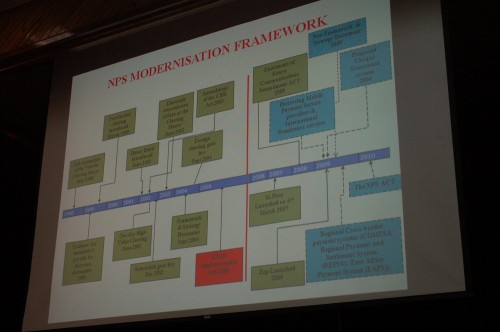

Kenya’s payment system timeline

You can see where Mpesa and Zap came into the timeline for payment systems in Kenya, but you can also see that it’s quite clear that the Central Bank of Kenya (CBK) thinks of many things beyond mobile payments.

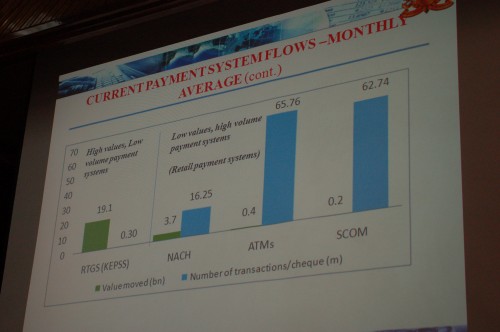

Low vs high volumes

Mobile payments are all the rage, clearly shown in the graph below. However, the amount of money flowing through the system from this is negligible compared to the other types of payments. There is a large difference between high volume systems versus where a lot of money flows, but with fewer transactions.

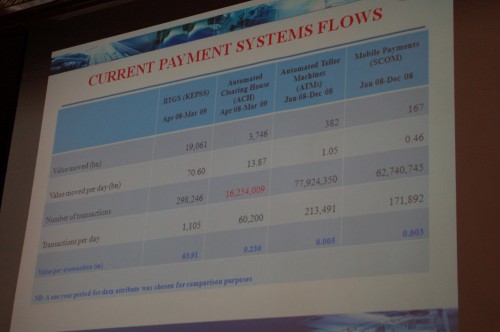

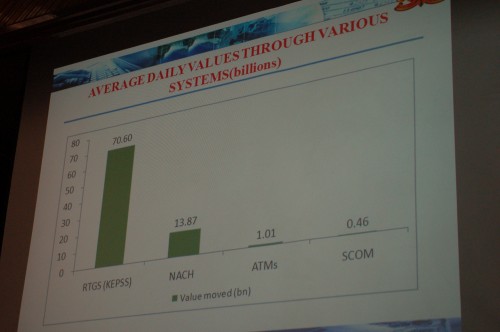

Current payment system flows

Low volume, high value. These are what the CBK care about. Taking a look at the following two slides, you can see that though mobile payments and ATMs are what everyone talks about, what the bank really cares about making sure that the real time gross settlement (RTGS) system stays on the tracks.

I’m attending the Fletcher mBanking conference in Nairobi today and tomorrow. Right now I’m sitting in the panel on “Perspectives on Mobile and Branchless Financial Services”. It’s quite a panel with, among others, Michael Joseph of Safaricom (of Mpesa fame), Adan Mohamed of Barclays Bank, David Proteous of Bankable Frontier Associates.

Points from the Panelists

David Porteous

He challenges Kenya to create a Kenyan model, not just of one-off success stories, but a Kenyan one that is open and usable by multiple actors in the country, not just one or two. Something that can be duplicated and used around the world. Lastly, he warns of “Regulator Flu”, much like Swine Flu it sweeps around the world and stifles innovation.

Adan Mohamed of Barclays

Adan starts with this provocative statement, “We will never have an environment where we have no branches.” He says it is ingrained in our psyche to use branches, and we will always need branches, so this idea of a branchless banking system is nice, but will run concurrently with the old status quo system. The use of technology continues to be small, it’s patchy, it’s mixed. There’s a long way to go, as people are nervous of what goes on behind this internet system.

Specific challenges revolve around regulation. For instance, if you want to run it 24/7, you have to get permission, you have to deal with money laundering rules, etc… He thinks that the central bank needs to be given a greater mandate. However, we need to see this space not revert back to the old ways, even as more control is given.

Customer contact tends to be low in a branchless system. He thinks this is a place where people want to be in touch and face-to-face with people. A lot of focus has so far been on the payment side of the occasion – we need to focus on the savings side of the equation as well.

Mark Pickens of CGAP

What we have today, is not necessarily what things will look like in the future, “what could disrupt the current landscape?” Mobile network operators are leading the charge. We think there will be 120+ initiatives like Mpesa in the next year around the world.

What is driving this for the mobile operators?

- 2.93B shillings from Mpesa of revenue

- Increases in loyalty

- Increases in users

- Globally think there is 1b ppl with a mobile phone but no bank account

Where else could innovation come from?

What if the kinds of technology that poor people had in their hand changed dramatically? If the phones that people had in their hands could browse the internet. Not smart phones, but sub $100 phones for this.

- Why would this matter?

- GPRS and EDGE are dramatically cheaper than SMS (75x cheaper)

- Mobile operators and banks would not own the customer due to owning the infrastructure. Anyone could reach out and find customers directly. The incumbents wouldn’t be as privelaged.

Localized creation of tools

3 main points:

Regulation. Particularly openness for non-banks to operate. Would there be a regulatory framework where this could be open for others to access and bes safe operating within? If we think that banking infrastructure needs to be openly accessible, then what is needed in the openness of mobile infrastructure?

Agents. The preponderance of Mpesa agents make a profit of $5/day. If there is limited capital in these dukas and agents, then how will he get liquidity to do it for anyone else? Maybe it can be done by extending lines of credit to the agents.

Consumers. The next round of innovation is beyond payments, but to use the wallet to store value. Who are the players that can provide this service on a safe basis? Paying for products directly would cut the cost for agents directly, and it would cut the cost of money within the system to the gov’t (2-3% of GDP). Poor people do have money, and they do save, but they put it at home in a jar, under the matress. What comes next innovation, is that the mobile needs to beat the matress

Peter Rinfretof Iris Wireless

Friction will continue to increase between operators, banks and other institutions like Western Union, etc.

The regulations and regulatory environment will change a lot for everyone. You’ll see regulations in one country that affect other countries. His example is the US is the largest remittance market in the world, and that has huge repercussions to what happens in the other countries around the world. Anti-money laundering rules will become stricter and more difficult for receiving countries to comply.

We’re not talking about a change of habit that is relatively new. This is money, something we’ve been dealing with for millenia. We’re talking about old habits dealing with money, so it will take time and it will evolve slowly. And it has to make sense within the market that you’re in. No two markets will look the same.

Michael Joseph of Safaricom

Mpesa launched in March 2007. It’s surprising to see how fast it’s grown. 19% of the population is banked, but 71% who have access to mobile phones in Kenya. The key success of Mpesa is not just good working technology, but to be successful with it you need to understand distribution. It’s not cheap. It’s not easy to put together an agent network that operates with integrity. “It is not build it and they will come.”

Customer growth is at 6.2 million customers in March of 2009 with over 11,000 new registrations each day. Trends: $1.7B moved in P2P transfers since launch. Average P2P transaction is just under 2500/= shillings ($30).

“This is what worries the banks, that we’re moving all this money around and they’re not getting any fees.” We’re not a competitor to banks, because they couldn’t operate on these small 30/= fee.

Safaricom has 300 staff dedicated to Mpesa. There are now over 10,000 agents. It’s the McDonalds effect” – whenever you are hungry there is a MacDonald’s. For us, whenever you turn around there is an agent.

“It is so important to have a regulator that is willing to take a risk with you.” It took nearly 9 months to convince the regulators in Kenya to allow them to launch Mpesa. We are treading new ground in Kenya, so having a courageous and risk-taking regulator made it possible. For money transfer we need some sort of regulation – a level playing field for others to do this a well. Regulation should facilitate and not frustrate.

“When we look back, money transfer will be the biggest thing that we ever did in the telecommunications world.”

I’ve got a new theory: one of the best tests of a tech community’s creativity is how many people are coming up with non-business related applications and games. It makes sense that the two games below come from Kenya and Ghana, two of the biggest “tech hubs” in Africa.

Another 3d Shooter from Nairobi

I think it’s a good sign that I just heard about a new 3D FPS shooter game called Mzalendo (not to be confused with the “eye on Kenyan Parliament website also called Mzalendo that Ory and M put together…). It is being created by Morgan of TriLethal Labs in Nairobi, and they have just released the Beta version of the tech demo outlining the capabilities of the New Siege3D graphics core.

Africa’s 1st iPhone Game?

I’ve profiled Wesley before, and he’s now partnered up with another game developer in Ghana named Eyram. Their newest claim is that they’re about to release (early April) the first iPhone game from Africa, called “BugzVilla” (I’m not sure if it is the first game, let me know if it is/isn’t).

It’s a game in which you crush bugs by tapping the screen and earn points as you level. Shake the screen to release more bugs, and watch out for the red ants! Here’s a short video on their new game:

I’ll try both of these new games out as soon as I can get my hands on them. Eyram assures me that their new game will be on the iTunes App Store in April, so you can bet I’ll buy it and play it.

I had a couple free hours this afternoon and decide to take advantage of it.

(higher quality version here)

Bodaboda’s are motorcycle taxis in East Africa (getting their name from the original bicycle taxis near the border of Kenya and Uganda). I decided to ask a guy if I could rent his for the day. 500/= Kenya shillings later ($7), and I was on my towards the Nairobi game park, to a reserve where one of my old school teachers now lives.

It didn’t go very fast, being 125cc and a cheap Chinese contraption, but that wouldn’t be advisable on these roads anyway. I got dusted a few times by a big lorry or bus, but was okay once I got beyond the main roads. There were quite a few animals around as I got closer to the reserve, nothing exciting, but fun none-the-less: giraffe, wildebeest, monkeys, ostrich and a bunch of Masai cows.

Best part: cutting the bike off in the middle of nowhere and listening to the wind blow through the bush. This is the Africa I miss.

I’ve had a rather active 5 days in Nairobi. Eventful enough to give an update on what’s going on with the Ushahidi developers, the pilot projects and some mobile phone fun. I head out tomorrow for Johannesburg for the MobileActive conference, and will also be attending the Friday night meetup and Barcamp Jozi on Saturday.

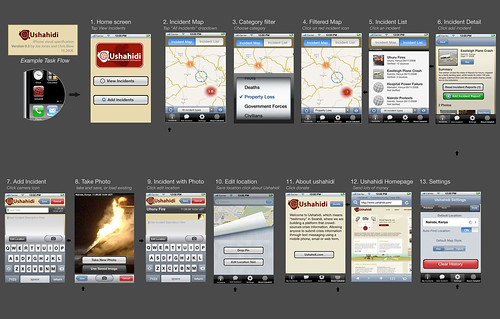

Ushahidi Smartphone Developments

(more on the Ushahidi blog)

Steve Mutinda put together a working Ushahidi Java application – and surprised me with it, this Saturday. It works well, and he and Wilfred Mworia are hard at work on the Ushahidi API to ensure that this app and the Ushahidi iPhone app both can sync with the database easily.

Speaking of iPhone apps, Chris Blow and Joe Jones have finished making changes from the feedback received on the first mockups. Wilfred Mworia starts this week on his new iPhone to get this working. We’re thinking it will take about 3 weeks.

(We’re still looking for feedback on the iPhone screens)

Ushahidi Devs Meetup

Just last night we had a great Ushahidi dev meetup in Nairobi. The combination of brains and energy in the room was just incredible. We ate good food, got up to speed on the latest Ushahidi news, and had a geeky good time.

One of our advisory board members was there as well, Patrick Meier, from the Harvard Humanitarian Initiative. He fit right in, as he also grew up in Kenya and went to secondary school in Nairobi.

Jason Mule and Wilfred Mworia are going to start running monthly Ushahidi dev sessions, so get with them if you want to jump in.

Pilot Project Meetings

The last, but probably one of the more important things that I’ve been doing while in town, is the meetings I’ve been having with the different organizations that have agreed to test out the alpha release of Ushahidi. This is extremely important for us, as it gives us a chance at some feedback and direct hands-on experience with launching Ushahidi instances in the wild.

More updates on this as we get through them, but in short, everyone is very excited about being a part of the pilot and the potential for Ushahidi to change the way the gather and visualize information from the field.

My good friend Josiah Mugambi in Nairobi was at the Kenya chapter of the Institute of Electrical and Electronic Engineers (IEEE) exhibition in Nairobi last weekend. This is where students showcase their innovation in engineering, ICT, mobile application and renewable energy. He did me a great favor by sharing some pictures and research that he did on some of the really interesting students he came across.

1. MPESA Online Shopping

By Denis Ndwiga Nyaga

Safaricom CEO Michael Joseph was especially interested in this one for obvious reasons. Denis called it ‘nakupesi‘, Naku for Nakumatt (the local mega-store). nakupesi is an online shopping mall, with payment based on MPESA. One would need to be registered on MPESA to be able to pay for items online via MPESA. One thing that is possibly lacking is delivery to one’s residence or office after purchase. This shouldn’t be too hard to incorporate though.

2. Green Tree Markets – a Business Intelligence tool for farmers

By Andrew Owuor

This looked quite interesting – A business intelligence tool that allows a farmer to choose where to sell his produce based on price, and location. Some of the obstacles that the developer Andrew Owuor mentioned include the need for real time market data from markets round the country, for the system to be of use. This isn’t a completely new idea, but it’ll be interesting to see what local twists are created for East Africa.

3 more…

3. Automatic headlight dimming for two approaching vehicles – By Jemimah Wachenje

Jemimah has developed a system that automatically dips two vehicles head lights when approaching each other at night. Josiah has ranted about headlights before, and I agree, it would be very useful and potential could reduce some accidents on those dark lightless roads around Kenya.

4. Energy harvesting using piezos to charge mobile phones – by Richard Assanga Otolo and Gilbert Barasa

Very interesting, yet practical.

5. Synchronous Solar Heliostat – by Samuel Njoroge

Sammy Njoroge’s demostration of a synchronous solar heliostat used to track the sun, and orient a solar panel accordingly thus improving the efficiency of solar panels. Automatic tracking of the sun to increase the efficiency of solar panels, Makes economic sense. Innovation runs in the family it seems.

© 2024 WhiteAfrican

Theme by Anders Noren — Up ↑