WhiteAfrican

Where Africa and Technology Collide!

Author: HASH (page 29 of 106)

Bankers are not well known for giving riveting talks. However, Stephen Mwaura Nduati gave a surprisingly interesting one here at the Mobile Banking conference just outside Nairobi. He’s in charge of “Payment Systems” at the Central Bank of Kenya – a regulator.

He made the case for why regulation is needed, and what risks are naturally inherent within payment systems. Not just mobile payments, but all systems.

What I was most interested in was his slides giving out some data on the payment system space within Kenya. It’s really quite revealing on what the motives are, and why they’re there, for the Central Bank and policy makers.

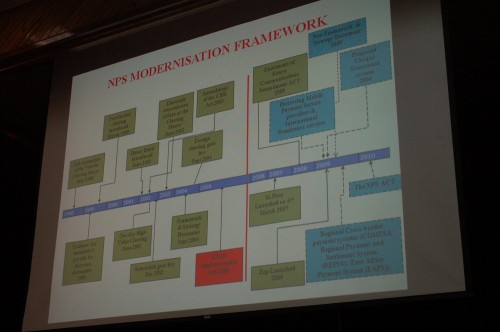

Kenya’s payment system timeline

You can see where Mpesa and Zap came into the timeline for payment systems in Kenya, but you can also see that it’s quite clear that the Central Bank of Kenya (CBK) thinks of many things beyond mobile payments.

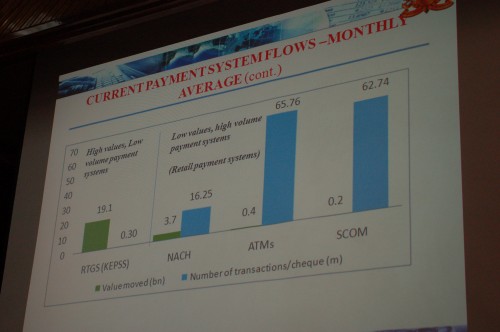

Low vs high volumes

Mobile payments are all the rage, clearly shown in the graph below. However, the amount of money flowing through the system from this is negligible compared to the other types of payments. There is a large difference between high volume systems versus where a lot of money flows, but with fewer transactions.

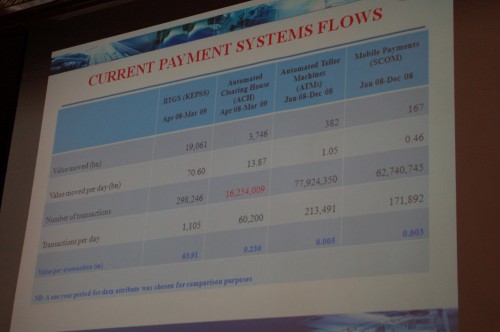

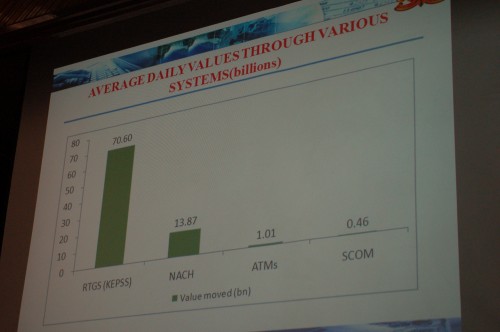

Current payment system flows

Low volume, high value. These are what the CBK care about. Taking a look at the following two slides, you can see that though mobile payments and ATMs are what everyone talks about, what the bank really cares about making sure that the real time gross settlement (RTGS) system stays on the tracks.

I’m attending the Fletcher mBanking conference in Nairobi today and tomorrow. Right now I’m sitting in the panel on “Perspectives on Mobile and Branchless Financial Services”. It’s quite a panel with, among others, Michael Joseph of Safaricom (of Mpesa fame), Adan Mohamed of Barclays Bank, David Proteous of Bankable Frontier Associates.

Points from the Panelists

David Porteous

He challenges Kenya to create a Kenyan model, not just of one-off success stories, but a Kenyan one that is open and usable by multiple actors in the country, not just one or two. Something that can be duplicated and used around the world. Lastly, he warns of “Regulator Flu”, much like Swine Flu it sweeps around the world and stifles innovation.

Adan Mohamed of Barclays

Adan starts with this provocative statement, “We will never have an environment where we have no branches.” He says it is ingrained in our psyche to use branches, and we will always need branches, so this idea of a branchless banking system is nice, but will run concurrently with the old status quo system. The use of technology continues to be small, it’s patchy, it’s mixed. There’s a long way to go, as people are nervous of what goes on behind this internet system.

Specific challenges revolve around regulation. For instance, if you want to run it 24/7, you have to get permission, you have to deal with money laundering rules, etc… He thinks that the central bank needs to be given a greater mandate. However, we need to see this space not revert back to the old ways, even as more control is given.

Customer contact tends to be low in a branchless system. He thinks this is a place where people want to be in touch and face-to-face with people. A lot of focus has so far been on the payment side of the occasion – we need to focus on the savings side of the equation as well.

Mark Pickens of CGAP

What we have today, is not necessarily what things will look like in the future, “what could disrupt the current landscape?” Mobile network operators are leading the charge. We think there will be 120+ initiatives like Mpesa in the next year around the world.

What is driving this for the mobile operators?

- 2.93B shillings from Mpesa of revenue

- Increases in loyalty

- Increases in users

- Globally think there is 1b ppl with a mobile phone but no bank account

Where else could innovation come from?

What if the kinds of technology that poor people had in their hand changed dramatically? If the phones that people had in their hands could browse the internet. Not smart phones, but sub $100 phones for this.

- Why would this matter?

- GPRS and EDGE are dramatically cheaper than SMS (75x cheaper)

- Mobile operators and banks would not own the customer due to owning the infrastructure. Anyone could reach out and find customers directly. The incumbents wouldn’t be as privelaged.

Localized creation of tools

3 main points:

Regulation. Particularly openness for non-banks to operate. Would there be a regulatory framework where this could be open for others to access and bes safe operating within? If we think that banking infrastructure needs to be openly accessible, then what is needed in the openness of mobile infrastructure?

Agents. The preponderance of Mpesa agents make a profit of $5/day. If there is limited capital in these dukas and agents, then how will he get liquidity to do it for anyone else? Maybe it can be done by extending lines of credit to the agents.

Consumers. The next round of innovation is beyond payments, but to use the wallet to store value. Who are the players that can provide this service on a safe basis? Paying for products directly would cut the cost for agents directly, and it would cut the cost of money within the system to the gov’t (2-3% of GDP). Poor people do have money, and they do save, but they put it at home in a jar, under the matress. What comes next innovation, is that the mobile needs to beat the matress

Peter Rinfretof Iris Wireless

Friction will continue to increase between operators, banks and other institutions like Western Union, etc.

The regulations and regulatory environment will change a lot for everyone. You’ll see regulations in one country that affect other countries. His example is the US is the largest remittance market in the world, and that has huge repercussions to what happens in the other countries around the world. Anti-money laundering rules will become stricter and more difficult for receiving countries to comply.

We’re not talking about a change of habit that is relatively new. This is money, something we’ve been dealing with for millenia. We’re talking about old habits dealing with money, so it will take time and it will evolve slowly. And it has to make sense within the market that you’re in. No two markets will look the same.

Michael Joseph of Safaricom

Mpesa launched in March 2007. It’s surprising to see how fast it’s grown. 19% of the population is banked, but 71% who have access to mobile phones in Kenya. The key success of Mpesa is not just good working technology, but to be successful with it you need to understand distribution. It’s not cheap. It’s not easy to put together an agent network that operates with integrity. “It is not build it and they will come.”

Customer growth is at 6.2 million customers in March of 2009 with over 11,000 new registrations each day. Trends: $1.7B moved in P2P transfers since launch. Average P2P transaction is just under 2500/= shillings ($30).

“This is what worries the banks, that we’re moving all this money around and they’re not getting any fees.” We’re not a competitor to banks, because they couldn’t operate on these small 30/= fee.

Safaricom has 300 staff dedicated to Mpesa. There are now over 10,000 agents. It’s the McDonalds effect” – whenever you are hungry there is a MacDonald’s. For us, whenever you turn around there is an agent.

“It is so important to have a regulator that is willing to take a risk with you.” It took nearly 9 months to convince the regulators in Kenya to allow them to launch Mpesa. We are treading new ground in Kenya, so having a courageous and risk-taking regulator made it possible. For money transfer we need some sort of regulation – a level playing field for others to do this a well. Regulation should facilitate and not frustrate.

“When we look back, money transfer will be the biggest thing that we ever did in the telecommunications world.”

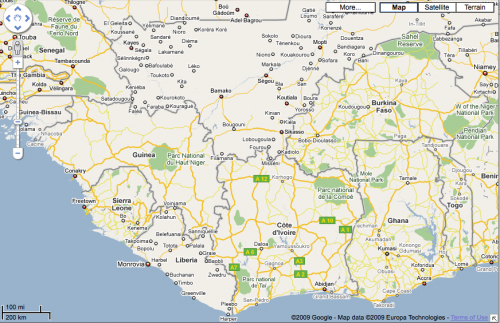

The Map-the-World and Map-Maker teams at Google have been making some major, and much needed, additions for Africa. With a large data push yesterday, Google Maps has one of the most impressive sets of maps on Africa that you can find.

There are now 27 more African countries that now have detailed maps, including:

Benin, Botswana, Burkina Faso, Burundi, Cameroon, Cape Verde, Central African Republic, Chad, Democratic Republic of the Congo, Djibouti, Eritrea, Ethiopia, Gabon, Guinea, Gambia, Ghana, Ivory Coast, Madagascar, Malawi, Mauritania, Mozambique, Niger, Nigeria, Reunion, Sierra Leone, Somalia, and Togo.

Comparing countries

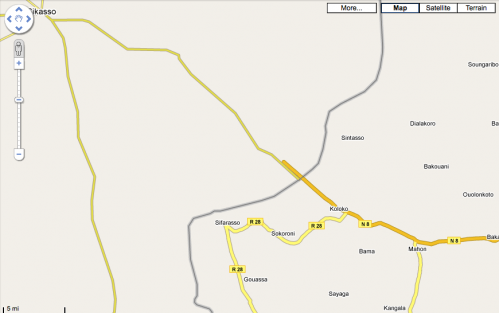

What I wanted to do was compare old map tiles with new ones, but I didn’t have any screenshots to do that with. Instead I did a quick comparison of a few countries – those that were just announced vs ones that weren’t on the list.

A good example of this is found when comparing Mali to Burkina Faso in West Africa. There are significantly more town names in Burkina Faso, and all the roads either have names or numbers. In Mali, which hasn’t been done yet, there are some major roads outlined, few towns are named, and no minor roads to speak of.

Also of interest, you’ll notice how the roads that should intersect at the borders, do not.

Here’s another interesting view of West Africa. You can clearly see that there has been a lot of data added for all of these countries, except for Liberia and Mali.

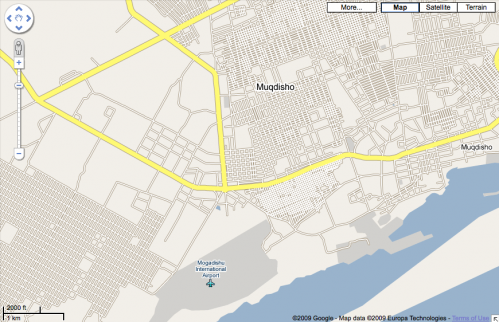

One other interesting map that I came across was of Mogadishu, Somalia. It appears that there either are no street names, or that the Google team working on this didn’t know what they were:

I’ve been fortunate to be part of the TED Fellows program, starting in Tanzania and then this year in California. It is definitely worth applying for, and I know there are going to be quite a few openings for TED India later this year.

(Watch the high-res version here)

Last week the BBC interviewed Dr. Diarra, the chairman of Microsoft in Africa. One of his quotes was memorable:

“Africa is really the last frontier in not only developing technology that is specific to people’s needs, but eventually even developing new business models that will enable the emergence of local software industries, such as young people who have the skills to be able to write their own applications for their own community,â€

I agree with the first part of that statement, it’s the second part that I find alarming. Coming from Microsoft, how can young people build the skills to write code when they can’t even pay for the closed software needed to run it? It’s not free, and if access (which he states earlier) is the biggest issue facing African technologists – then how does closed software fit into the equation?

Let’s say that the developer communities do emerge even with that hurdle, we’re still left with what one person wrote: “…they will be formed from programmers who are completely dependent on American software for the livelihood: it’s neo-colonialism, pure and simple.” At it’s worst then, African governments are paying for Western products, and are dependent on these large organizations to maintain and support critical systems.

Netzpolitik writes an interesting piece, pointing to a recent WSJ article and talking about how Microsoft positions itself within education and government circles in Africa, thereby cutting off major revenue sources for open source developers and organizations that originate from within the continent.

“Of course, Microsoft does not come for free – the hidden price tag is not just attached to the licensing costs but also to the ownership of innovation and data. Microsoft should be supporting local developments instead of stifling them and dealing with them as competition.”

Monetary and Knowledge Costs

There really are two costs when dealing with software: the expense of buying and maintaining it, and the knowledge cost within the local programming community. The monetary side is a short-term cost relative to the knowledge costs (core competency) that a nation does, or does not, develop over time.

In Africa organizations have a lot of hurdles to overcome, not least of which is the straight cost of doing business. Where it might be simple for some organizations in the US and Europe to wave off a couple thousand dollars worth of licensing fees, the same is not true in Africa. The margins are lower, so every cent counts.

In a region where cost is so important, it’s amazing then that the most lucrative deals go to the Western organizations that have high costs for ownership and maintenance. These outside organizations use backdoor methods to gain contracts where in-country options are available, usually with less expense and with greater local support.

The bigger problem is the knowledge costs, or lack thereof, when closed source organizations muscle into the most lucrative fields. What the country ends up doing is stifling its own programming community. Without money trickling back into that community, its growth is stunted. Instead of young developers learning the fundamentals of coding in open code, they end up going to work in an office that runs proprietary systems.

Ushahidi and Vine

The last year has taught me a great deal about working in the open source space. Not just in developing a tool using these principles, but in helping create a non-profit technology organization focused on open these same fundamentals. That is, we believe that the best use and furtherance of our technology, and our organizations goals, is done with and by the greater community that grows around it. We serve as a focal point from which this community gains energy and to act as a group which is dedicated to the core framework of the tool itself.

Do all situations need and/or require open software? No. In some cases closed-source options are just plain better, which is why I have no problem buying great apps for my PC, Mac or iPhone that make my life easier. I don’t believe that all technology has to be open, though I do think that by keeping it completely closed most companies will be bypassed by their open counterparts in the long run. Good examples of this are the Firefox browser and WordPress blogging platform – possibly Android.

A couple of weeks ago Microsoft announced their new Vine product. It has a lot in common with Ushahidi, including sending and receiving of alerts via SMS and email. To be honest, we have no ownership of this idea, but what we do have is a question as to why Microsoft believes and works to create crisis and emergency systems in a closed way.

Some thoughts from other bloggers on this same issue:

“Crisis reporting is something that wants to be free. It needs to be free, community owned, a service that just exists.”

“There is nothing in Vine that you cannot already do with a combination of Ushahidi’s proximity alerts and the path-breaking SMS based forms updates from FrontlineSMS. Having met with the best and brightest of Microsoft Research, key members of the team behind Vine and the team behind the new version of Sharepoint and Groove, Microsoft have nothing that comes close to the capabilities of FrontlineSMS today with regards to forms based data transfers over SMS in austere conditions, which is precisely what is needed for decision support mechanisms and alerting post-crises.”

“The ownership of a crisis reporting system by one company seems unattractive from a consumer as well as a security perspective. It is not unlikely that this will become yet another failed attempt to override instead of collaborate with existing local solutions.”

Unless Microsoft is creating something truly revolutionary, which I don’t see that it is in Vine, then I would rather see them put their development muscle behind something that actually is. It doesn’t even have to be Ushahidi. Finally, if they really are about creating emergency and disaster software for use by normal people, then I would encourage them to not charge for it and to make it as open as possible for others to work with it, including Ushahidi.

[Sidenote: Interestingly enough, the first pre-beta smartphone app that was finished for Ushahidi was the Windows Mobile version. We all chuckled, and then gave a quick dig to the ribs of the devs doing the Android and J2ME apps, to get them going. To us, it didn’t matter that it was the service created for our friendly closed-source giant finished first. In the realm that we find ourselves in, crowdsourcing crisis information, it doesn’t matter what device you use – it just needs to work.]

(Blue Monster image by Hugh MacLeod)

There have been a couple new entrants into the mobile and web space in Africa that I haven’t had a chance to review adequately. One of them is The Grid, by Vodacom. Also in this post is a new documentary on mobile phone use in Africa.

There have been a couple new entrants into the mobile and web space in Africa that I haven’t had a chance to review adequately. One of them is The Grid, by Vodacom. Also in this post is a new documentary on mobile phone use in Africa.

The Grid (Tanzania)

“The grid connects your cellphone and web browser into a social network that is aware of where you are. It uses cellphone mast triangulation to detect where you and your friends are and helps you leave notes on the places you go to”

The Grid launched into Tanzania in April. According to Vincent Maher, who heads up the project, there has been very favorable growth rates of the service.

Besides being a well designed and well integrated mobile/web social network, what I’m really looking forward to hearing about is The Grid’s location-based advertising unfold. For launch, they have partnered with Nandos, Sportscene, Jay Jays and Synergy pharmacies to deliver advertising within radii ranging from 0 – 10km from a users physical location. Vodacom has the muscle to pull this type of thing off, and the connections to create the advertiser relationships.

The Grid is really a direct competitor to Google Latitude (I’ve written about this here), something I’m really excited to see coming out of Africa.

Hello Africa

A documentary about mobile phone culture in Africa. I was excited to see the trailer for this last month, and the full version is now available. Find out more at ICT4D.at

Hello Africa from UZI MAGAZINE on Vimeo.

Before 2001, the year the first cell tower was erected in Zanzibar, people had very limited means of communicating with each other from a distance. Today, the situation is completely the opposite. Cell towers from main operators cover the whole island and people communicate all the time with their mobile phones. It is difficult to imagine how it once was before.

There are plenty of aspects about the ongoing changes that could be covered in a documentary, but the purpose of this fillm is not to elaborate and draw conclusions. The purpose is to catch the vibe, the know, show what’s going on right now. A snapshot of the Zanzibarian zeitgeist.

Jon Gosier runs Appfrica Labs. He’s been hard at work over the last year promoting technology all over Africa on his blog, and at the same time building a base for the technology incubator Appfrica Labs that he launched late last year with some external funding from European VC firm Kuv Capital. Jon is one of the most capable, energetic and social programmers that I know. He is entrepreneurial, understands the business side of things as well as the nuts and bolts of developing. In short, he’s about the perfect person to put your money behind if you’re going to invest in the African startup tech space.

Innovation in Uganda, by Ugandans, for Uganda

There’s something very powerful about the focus that Jon is applying to Appfrica Labs. I’m sure that there are opportunities and applications that he will incubate that stretch beyond Uganda, but he’s taking a measured approach. There’s enough low-hanging fruit in Uganda for him work on, so he’s starting there.

“The mission is to offer opportunities and work experience for East African software entrepreneurs so that they can then use their talents to bolster the growing local markets by creating their own products and companies. We pick up where local colleges like Makerere University leave off by offering hand-on experience in Java, C++, C#, Ruby on Rails, Django and Python, PHP, Perl, Kannel and various other programming languages that often can’t be taught in-depth in classes due to budget restraints.”

Jon notes that there are over 60,000 Facebook users in Kampala, and instead of creating yet another social network, he has decided to focus a fair bit of early development into this platform. He doesn’t focus on Twitter or other “hot Web 2.0 apps” which aren’t being used there by enough people yet.

Proof is in the development

A good example of this local Uganda focus is the apps and tools that are being developed right now. Here are just a couple examples, and I know first-hand that there are more on the way shortly:

Status.ug – an inexpensive, and efficient, mobile gateway for Ugandans to update Facebook via their mobile phone.

Answer Bird – Uses Facebook Connect to allow questions to be asked and answered in a Twitter-like interface more here).

Answer Bird – Uses Facebook Connect to allow questions to be asked and answered in a Twitter-like interface more here).

OhmSMS – Get an SMS when your power is off at home or at the office, simply by keeping a cheap mobile phone plugged into an outlet.

Why this works

Appfrica Labs is not only a great idea, but it’s a blueprint for a new way for technologists to band together and create something in the face of a lot of difficulties in Africa. We all know of the problems faced when trying to get seed capital, or of the lack of traction when trying to sell ideas to the government or big businesses within a country.

What Jon has been able to do is create a brand which others can rally around and push their efforts forward as a collective. It’s about marketing, messaging and communication. He’s made a lot of headway for not just himself, but the other entrepreneurs in Uganda due in no small part to the hard work and late nights put into his blog, creating his own code, and promoting his message at conferences.

We have yet to see the final outcome of all this labor, but it’s an extremely strong start that leaves me optimistic about the future of Appfrica Labs and any other innovation hubs that pop up around Africa. Rebecca Wanjiku is right, Africans should stop whining and work smart, collectively to get new technology built, released and adopted throughout the continent.

I’m thoroughly enjoying Dambisa Moyo’s “Dead Aid” book. Buy it, has great food for thought, and numbers to back it up.

The New York Times article on big web content companies lack of profitability in places like Africa.

We’re seeing a new trend of microblogging platforms emerge across Africa. Most recently in the Congo with Akouaba, but also in Nigeria with Naijapulse and South Africa’s Gatorpeeps.

Matt Berg writes about the “Off-grid solar calculator” in North Africa.

Mobility Nigeria points out that Nigeria displaces Germany in the Opera Mini top 10 list.

Bankelele breaks down some of mobile payment tool M-Pesa’s strengths and weaknesses in Kenya.

We’ve announced Ushahidi’s Beta stage, and another round of funding.

APC talks about the broadband rollout issues and a movement to change policy in South Africa.

“Piki piki” is motorcycle in Swahili. That’s how I think of them, it’s what my daughters call them, and it’s what I want to write about today even though it has nothing to do with African tech… 🙂

The Rise of the Motorcycle Taxi in Africa

There has been a massive increase in the number of motorcycles in Africa over the last couple years. As an example, the story I got from more than one source in Liberia last month was that a year ago there were only a few motorcycles on the road. Now the country is covered with thousands of “peen peen’s”, their local motorcycle taxis.

As I travel, I like to test out the local motorcycles. Usually this means me finding a local motorcycle taxi driver and renting the bike off of him. It’s questionable whether a guy my size is going to fit onto the back of one of these 125cc cheap Indian and Chinese bikes. Plus, most of the drivers are horrible and there’s no way I’m putting my life in his hands. Here is a video of me testing out a “boda boda” in Kenya, and in the middle (1:38) of this Liberia video I test a “peen peen” out briefly.

The Business Side

Whenever I’m in a new country, I take the time to sit down and talk to the local motorcyclists. I’m curious as to when the bikes started showing up in numbers, how much they cost, and how much they charge to drive people around. I’ve started to wonder if it’s the same Indian and Chinese suppliers all over the continent, since you can buy the same models from Kenya to Liberia with the same average pricing of $500 – $1500. You know when someone has some money, since they ride a Yamaha, Honda or some other Japanese motorcycle.

On the business side, the motorcycle is bought by an entrepreneur who has some capital, who then rents it out to a taxi driver who pays him a daily rent on the bike. Anything he makes above rent, he keeps, and then one day a week (Saturday) he doesn’t pay any rent and keeps all the profits. Meanwhile, the owner has to cover maintenance, insurance and registration costs, fuel costs are covered by the driver. The owner’s goal is to get a small fleet of 4-10 motorcycle taxis on the road.

Here’s a breakdown for one owner/driver in Liberia:

- “Nafa” Chinese motorcycle cost: $750

- Daily driver revenue (avg): $22

- Daily driver rent: $8

- Daily driver fuel costs: $3

- Daily driver profit (avg): $11

Maintenance and Modding

I’m also intrigued by how they keep them running and how they get modded by the riders. Sometimes you’ll see radios strapped to the handlebars, stickers, signs and tassles. Helmets, when worn, are a hodgepodge of any type of hard head covering that can be found, from construction to racing helmets, they’re all there.

In West Africa, fueling is done via roadside stalls that sell gasoline by the jar or bottle. In East Africa they generally get filled at normal stations or via drums in the more rural areas.

Gallery

© 2025 WhiteAfrican

Theme by Anders Noren — Up ↑