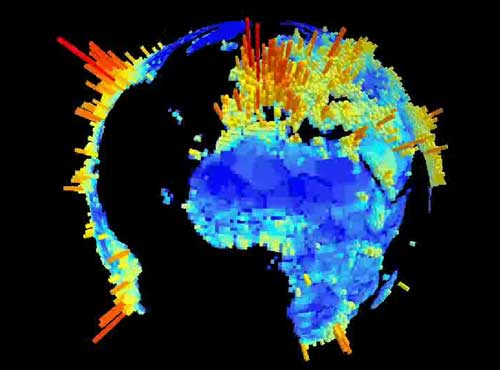

The ability for eCommerce to thrive and flourish is directly correlated with the ability of merchant and buyer to trade money – to transact a payment. I keep hitting on this because I see it as one of the key factors in developing a viable African eCommerce industry.

The ability for eCommerce to thrive and flourish is directly correlated with the ability of merchant and buyer to trade money – to transact a payment. I keep hitting on this because I see it as one of the key factors in developing a viable African eCommerce industry.

It turns out that Microsoft is also very interested in figuring out some answers for this space. Particularly as it results to micro payments. These can be considered payments of $10 or less that end up costing merchants a relatively large amount to the credit card companies.

For instance, when we offered “Premium” eBay templates on List’d last month for $1-$5, the best rate we could find was through PayPal’s micro-payment system – and that still wasn’t very attractive (though much better than your normal merchant fee).

Microsoft’s move into Internet payments could threaten credit card companies’ online profits. Gates described a system that would undercut credit card fees, making it profitable for an online newspaper to charge small fees for individual articles, for example.

“If you want to charge somebody $0.10 or $1 a month, that will just be a click…you won’t have to manage some funny thing or pay some big credit charge, where half of it goes to the clearing,” Gates said.(link)

I am very interested in seeing where this goes. Depending on the strategy that Microsoft uses to implement this, I think it could be groundbreaking and completely change the dynamics of eCommerce as we know it.

(via ArsTechnica)

The ability for eCommerce to thrive and flourish is directly correlated with the ability of merchant and buyer to trade money – to transact a payment. I keep hitting on this because I see it as one of the key factors in developing a viable African eCommerce industry.

The ability for eCommerce to thrive and flourish is directly correlated with the ability of merchant and buyer to trade money – to transact a payment. I keep hitting on this because I see it as one of the key factors in developing a viable African eCommerce industry.