Morris Mbetsa is a 19 year old Kenyan with a lot of good ideas. If that was all, he wouldn’t be that special, however, he actually builds prototypes of his ideas and they end up being quite extraordinary. The first time we covered his “Block and Track” SMS-based vehicle security system on AfriGadget. This time he’s come up with a web application – the “Wakenya” system for tracking Kenyan citizens virtually via mobile and web.

The frustrations of tech entrepreneurship in Africa

Morris and I got together shortly after his first system was created. He shared a couple other ideas beyond that first invention with me.

He had received a lot of attention due to the Kenyan TV coverage, but it hadn’t turned into any real money for him. No one within Kenya was interested, either as a business partner or funder. There were a couple international groups that were trying to angle in on him, but when I spoke to him he didn’t know or trust them. What he had was all the makings of a sad story of inventiveness leading to… nothing.

This is our story in Africa isn’t it? How so?

- We’re continually fighting to get our own money people interested in what we’re doing. We lack seed capital and no one locally cares.

- We need business mentors that we can trust, ones that we’re not always worried about being fleeced by overnight. Ones that aren’t just looking out for how they can either steal the idea, the IP or the equity.

- Lacking any local funding or business partners, we hope that an international funder will notice us.

- If we’re able to get international attention, the next trick is trying to figure out if any of these people are real, honest or legitimate.

It’s frustrating. Why won’t anyone locally come in and fund an idea? Not just an idea, as in the case of Morris Mbetsa and others like Steve Mutinda, but real prototypes. These are working models. (I could go off on a tangent talking about all of the great software developers in Africa who talk a lot about good ideas but never build them – but that’s another post). No, these kinds of guys actually build the prototype first, then try to find someone to fund it. Basically, they’re doing it the right way.

Does the government have a role?

It should, but only in so much as they create a system which limits the hurdles that entrepreneurs need to overcome to create a business, get funding and bring their ideas to market (not just for tech, but for everything). Private investment should be the lion’s share of this type of growth for the country, but in Morris’ case, he’s created a system for Government, so there should be some government funding for just this type of activity.

In fact, Kenya went so far as to create the ICT Board a couple years ago for this express reason:

“To rapidly and innovatively transform Kenya through promotion of ICT for socio-economic enrichment of our society.”

Here we have a young Kenyan with (many) good ideas and prototypes. He needs some structural support though, and we hope he gets it before the vultures descend. I know Paul Kukubo, Al Kags and a couple others within this group – they’re good people and have big ideas themselves. I know that they’re trying to come up with big structural ways for Kenyans to access ICT services and for Kenya to become an global ICT hub.

My question is this: How will that ever be the case if guys like Morris Mbetsa don’t have the requisite government structures in place to allow them to succeed?

3 groups and food for thought

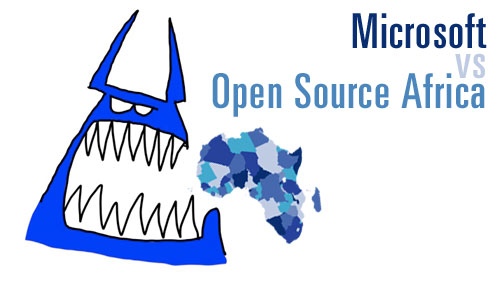

We have a foundational investment-in-innovation problem in many parts of sub-Saharan Africa. If Kenya is one of the top 5 African hubs for technology, then we know that the rest of the countries are in similar or worse conditions than this. What is it going to take for us to truly setup an ecosystem of entrepreneurship and the structures that support innovation, especially in the tech sphere?

1. Outside investment as catalyst

I’m starting to wonder if it will take a concerted effort by investors in the international space who can inject large amounts of capital into business ideas that have potential. Why international, isn’t local good enough? Normally it would be, but international investment comes with some benefits that local investment doesn’t. As anyone who lives in places like Nairobi knows, almost any money you take locally comes with two problems. First, it’s usually a small amount given for an excessive demand on equity. Second, it comes with political ramifications that tend to compromise the receiver of the funds.

Is what we really need a shakeup? A wake-up call for the local investor to realize that they will miss out on the big ideas and products if they don’t create a local system that allows real innovation to flourish, grow and enrich the inventors.

2. Government mechanisms for entrepreneurs

Outside investment as a catalyst for change in this space is one possible idea, but it’s not enough. As mentioned earlier we also need someone within our highly-bureaucratic government system to create a channel for entrepreneurs and investors to act. This could be accelerated business entity creation, and it would likely include lowering certain licensing terms and restrictions. My guess is it would also mean a structure for low-interest business loans as well.

3. A united technology community

Lastly, we need the technology community itself to band together. This is coming into being in a few countries, places where we have techies networking and creating relationships with business people and government. We’re starting to see when an investor comes into town, people okay with sharing the names of other entrepreneurs that have good ideas, and not trying to just tie that investor down with their own stuff.

While there will always be competition, lets put aside the tendency to pull someone else down when they’ve achieved some modicum of success. Instead, trumpet the small wins and help each other get ahead. Goodwill pays off so much better in the long run.

Finally

You can see this is something that I’ve been thinking about a great deal, and it bothers me to no end. For, if we don’t fix this we’ll continue to have the best and brightest head to other parts of the world – there is no industry where this is easier to do than the digital one. With them goes all the intellectual capital, inspiration and revenue that would further enrich our own continent.

I’m determined to play my part in seeing change happen. I want to see real technology powerhouses grow within Africa – ultimately with African investors and with solutions that will take the world by storm.

[Interesting update on Morris]