There have been a lot of negative rumors and one-sided stories across Kenyan social media of late about the business changes at Angani, a Nairobi-based Cloud services company, and the subsequent platform outages that occurred. It’s an unfortunate state, as people I’ve known and respected for many years have not tried to get the “other side of the story”. A few have reached out, and after doing so have chosen to remain silent rather than go against the current meta-narrative that is being pushed.

That meta-narrative is, “white investors are abusing their money and privilege to push out black Kenyan founders of a company to steal it.” This is factually wrong and will have long-lasting negative repercussions if not corrected. The racial overtones alone demean us all. We’re better than this.

The real meta-narrative of this story is one of inexperienced management and the subsequent irresponsible behavior of startup founders, and how that reflects on the Nairobi tech ecosystem at large. It’s about growing pains and learning, and also about a community coming to terms with the need for more professionalism when scaling and growing companies. It’s about what independent board members and investors rights and responsibilities are.

To understand why these allegations are wrong it’s first helpful to understand what drives investors (from any country) and their actions.

On Investors

Tech investors are driven to invest in companies that can scale, gain market share and subsequently make profit. They look for great teams that have good ideas that they can execute on and pivot with as the business landscape changes around them over they years. Typically investors have financial interests in numerous companies at any given time, and depending on how much capital they’re injecting, they will take a seat on the board to represent their interests.

Because they have so many companies, the best case scenario is when a team is executing well and the investor has little need to be involved in anything but receive updates so he/she can help where asked. The worst case scenario is when you have to spend days or weeks working on a company and can’t give attention to the other dozen companies you’re supposed to be working with. In short, no one wants any drama.

That said, as an investor you’re also a significant shareholder and typically represent a number of other shareholders when you have a board seat. When you’re making decisions at board meetings, you’re doing so for these people as well, and your mandate is to find a way forward that increases that shareholder value.

So what happened?

Unfortunately, at Angani, an all too common story emerged of inexperienced founders (knowledgeable, but inexperienced in management) who couldn’t overcome personal differences in order to run a company, and had seen a decline in revenues over the preceding 3 months (37% in June, 17% in July and in August).

When you take a sizable investment your company isn’t the same anymore, if things get tough (as they often do at some point in a company’s life), then you’ll have others outside of the original founding team weighing in to solve issues with you. In this case, that’s what happened, and the independent board members did the job of oversight and governance. A number of viable options were proposed and considered, whether that be restructuring the company or changing executive positions, however two of the founders rejected any board recommended changes and opted instead, to leave the company instead and walk away.

Following this board decision was a period in which access to the company’s key infrastructure was supposed to be handed over. This didn’t happen, which precipitated even more issues that culminated in the platform failing and taking down client accounts. It was at this point when Angani issued a statement explaining the system failure.

This is far from the sensationally incorrect story of a hostile board takeover by investors. It’s an old story that can happen across any industry in any country.

Final Thoughts

Startups fail. Sometimes this is due to bad ideas, business or operating models, others to poor financial management, and some to founder disputes. This happens everywhere in the world and is unfortunately the norm for tech startups.

However, we can’t allow ourselves to change the dialog to something that it isn’t. This isn’t about race but instead the simple realities of how ugly and painful it is when a company goes through real management challenges. Nairobi has benefited from an openness to foreign talent and investment for many years – and it shows in the successes that have happened since. We should try to learn from this so that we don’t repeat these mistakes or, worse, that we develop a reputation as a petty and unprofessional investment market and further scare away foreign investments.

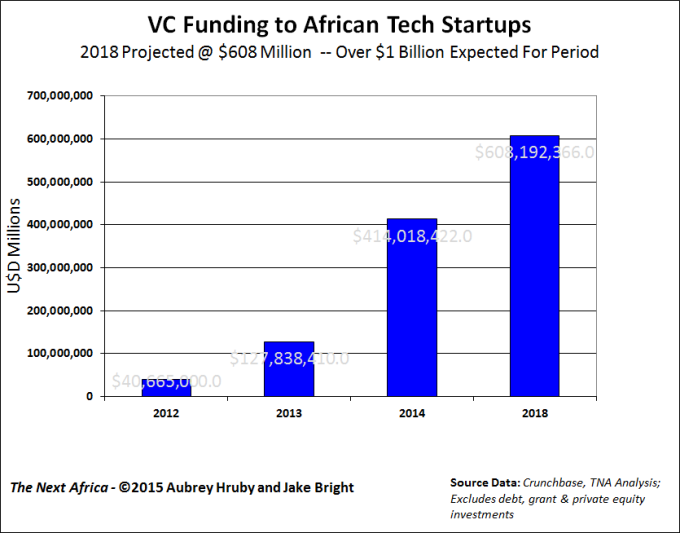

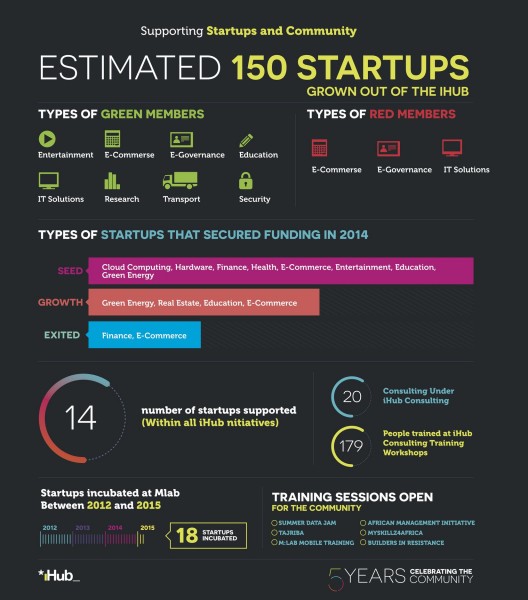

We’re one of the most dynamic and active tech communities on the continent, and because of this have high visibility to investors. Capital will not continue to flow to other startups in Kenya if investors believe that a gun can be held to their head on governance and oversight issues of their investments. There are other places that they can go where the community will be more investor friendly, and where they can fall back on the rule of law to protect themselves.

Our tech community is a work in progress, it takes all of us working together to make it better. We need to get this startup and growth stage of tech companies in Kenya right – we can do better, and we will.